The Saroya family

Balancing age-old beliefs and modern life.

|

| Lori Saroya and her husband, Kashif, struggle with adhering to Islamic teachings while living in the U.S. |

| MMA | 0.69% |

| $10K MMA | 0.42% |

| 6 month CD | 0.94% |

| 1 yr CD | 1.49% |

| 5 yr CD | 1.93% |

(Money Magazine) -- Kashif Saroya held out against getting a credit card for as long as he could. As a Muslim, he was mindful of the prohibition in the Qur'an, Islam's holiest book, against paying or receiving riba, usually understood as interest. That meant no plastic.

But just saying no to credit in a country that runs on it was a lot harder than Saroya anticipated - as he learned one day in 2003, five years after leaving Pakistan to study and work in the U.S.

The Minneapolis resident needed to rent a car to pick up his parents, who were flying to America to visit him for the first time. But the rental agent wouldn't hand over the vehicle without a credit card. Panicked that he'd leave his parents stranded, Kashif got a friend to rent the car and let him sign on as a second driver. A few days later he applied for his own Visa. Just in case.

Saroya and his wife, Lori, both 28, constantly feel the tug between their desire to adhere to the teachings of Islam and the practical realities of life in the modern U.S.

Take the Muslim admonition against paying or earning interest. Strictly interpreted, the rules make it tough to buy a house (traditional mortgages are off-limits), finance a major purchase (no credit cards), or put together a diversified portfolio (no bonds). Investing in stocks is limited as well - companies involved in forbidden activities (such as lending, gambling, and serving or making alcohol) are prohibited.

Lori, who grew up in Iowa, has also found that compromises are sometimes inevitable. Her scholarships and part-time jobs weren't enough to pay for college in St. Paul, so she reluctantly took out more than $30,000 in student loans - but only after first consulting Islamic scholars, who assured her that borrowing for her education was permissible.

The couple met in Minneapolis, while Lori was still at school and Kashif was working as a systems analyst. He had launched a summer camp for Muslim youth; Lori volunteered to be a counselor there. Their 2004 courtship was a new-world twist on an old-world arranged union: Former campers set them up on a chaperoned date; within three months they were married.

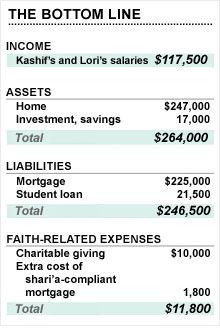

Soon afterward, they bought a $247,000 four-bedroom home in the suburbs. To finance the purchase, Kashif found one of the few U.S. banks offering a mortgage compliant with shari'a, or Islamic law. It's not, strictly speaking, a loan. Instead, the mortgage is structured as a purchase of the home in partnership with the bank; the Saroyas' monthly payments are part rent, part repurchase of the bank's share of the house. The mortgage costs $1,800 a year more than a conventional loan. But it's worth it, says Kashif: "We didn't want to feel that we took the easy route for our own financial comfort."

The Saroyas earn a healthy income for a young couple - between Kashif's job in IT and Lori's work for a victims' services program, they make $117,500 a year. But they don't spend much on themselves. Their biggest outlays are on community service work. Lori estimates that, for one, she's spent about $15,000 to establish the Minnesota chapter of the Council on American-Islamic Relations, which advocates for Muslims facing discrimination.

The couple also follow Islam's rules on zakat - a charitable donation roughly equal to 2.5% of their net worth. While they're obligated to give only $500 a year, the Saroyas donate $10,000. "Whatever you have," says Lori, "there are other people who need it more."

Their long-term goals, however, are costly. They'd like to make hajj - the pilgrimage to Mecca that, like zakat, is a pillar of Islamic faith. They'd like to start a family. And they'd like to retire in their fifties to do community service full-time.

To reach those goals, they realize they need to invest (currently they have only $17,000 saved). But they've been reluctant to do so - Kashif didn't contribute to his 401(k) for the first four years he was eligible and now puts in only enough to get the company match - because they worry their choices will be unacceptable under Islam. "We don't want to do something inappropriate," says Kashif.

To help the Saroyas make the right choices, Money consulted Mohammad Raghib, a financial adviser in Los Alamitos, Calif., and Monem Salam, vice president of Islamic investing at Saturna Capital. Here are their suggestions:

Embrace stocks. While many Muslims share the Saroyas' wariness about investing in stocks, Salam says it is permissible as long as they avoid companies that derive revenue primarily from unacceptable businesses.

The easiest way: Invest through a mutual fund that screens companies on the basis of their adherence to Islamic principles. Examples include Amana Growth (AMAGX), managed by Salam's company; Azzad Ethical Mid Cap (ADJEX); and Iman (IMANX). So that Kashif can put these funds in his 401(k), Salam suggests he lobby his employer for a self-directed brokerage account option in the plan.

Kashif likes the approach Salam describes. So does Lori, who says, "Now I feel more comfortable about investing in stocks."

Get the right mix. To be properly diversified, Raghib says, the Saroyas should have some income investments in their portfolio. Since bonds are out of the question, Salam points out two alternatives. One: Islamic mutual funds focused on dividend-paying stocks, such as Amana Income (AMANX) or Azzad Ethical Income (AEIFX). The second is to put a larger amount than usual into cash accounts (see below).

Kashif agrees that it's a good idea to include some investments that offer more stability. If he can't invest through his 401(k), he says he'll open an IRA to do so.

Make savings pay too. Raghib advises the Saroyas to add $150 a month to their liquid savings until they have $20,000 set aside for emergencies. The money should go in a shari'a-compliant savings account, structured as a profit-sharing agreement, which would give them a yield on their money while adhering to the rules against earning interest. One option: a University Islamic Financial Corp. money-market account, recently paying 1%.

Both Lori and Kashif like the idea of the shari'a-compliant account. But Lori rebels against setting aside so much. "I can't imagine having that much in my account and not using it to help other people," she says.