Madoff: I'll do the time

Madoff, convicted Ponzi schemer, decided not to appeal his 150-year sentence, says lawyer.

|

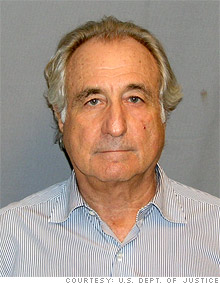

| Bernard Madoff, shown here in his mug shot, is still being held at MCC in Manhattan. |

NEW YORK (CNNMoney.com) -- Bernard Madoff, mastermind behind the largest Ponzi scheme in history, has decided not to appeal his 150-year sentence, according to his lawyer.

"The decision has been made, and that's it," said defense attorney Ira Lee Sorkin.

Sorkin said that Madoff is still at the Metropolitan Correctional Center in Manhattan, where he has been held since March 12, when he pleaded guilty to 11 federal counts related to the scheme.

Madoff is also being forced to forfeit $170 billion worth of assets to compensate his victims: More than 1,300 investors, according to the latest tally from federal authorities, whose life savings in many cases were wiped out by the elaborate, decades-long scam.

At the June 29 sentencing in U.S. District Court in New York, Sorkin requested that Madoff be sent to Federal Correctional Institute Otisville, about 70 miles northwest of New York City, where he used to reside in a $7 million apartment.

FCI Otisville is a medium security prison with an adjoining prison camp, a textile factory, a full-time rabbi and "one of the largest and most active religious programs for Jewish inmates in the Bureau of Prisons," according to Alan Ellis, a prison consultant and author of the "Federal Prison Guidebook." It is also one of the closest medium-security prisons to New York City, where Madoff has family.

Because of the length of his sentence and the wide and sweeping nature of his crimes, Madoff would not be eligible for a prison of low or minimum security, which is generally preferred because of safety and quality of life, according to prison consultants.

Sorkin said that Judge Denny Chin said he would recommend a prison in the northeast to the Federal Bureau of Prisons, which has the final word in such matters.

Madoff orchestrated his scam by masquerading his investment firm as a legitimate business. But the business became a front for a Ponzi scheme, in which the scammer uses fresh money from unsuspecting investors to make payments to more mature investors, creating the false appearance of legitimate returns. ![]()