Stocks brace for September

The week ahead brings reports on manufacturing and the job market, as investors try to stretch out the advance.

|

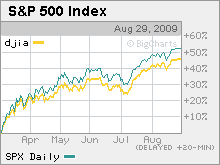

| The S&P 500 has risen 52% since the March lows. |

NEW YORK (CNNMoney.com) -- With stocks now sitting more than 50% above March lows and notorious rally-spoiler September in sight, the calls for a pullback have been getting louder.

But the momentum of the stock rally and other signs of optimism in the economy might just keep investors buying.

"We're up sharply from the lows, moving into the seasonally weak September through October period and everyone is talking about a correction," said Rick Campagna, chief investment officer at 300 North Capital. "And that's why it won't happen."

Stocks could see a modest pullback, equivalent to the 7% slide in the S&P 500 in late June through early July ahead of the quarterly results, said Jack Ablin, chief investment officer at Harris Private Bank. But a bigger 10% to 15% retreat is likely avoidable for now, he said.

"The advance is consistent with reasonable valuation and an improving economy," Ablin said.

Improving housing and manufacturing reports, better-than-expected quarterly results -- and the infusion of trillions in fiscal and monetary stimulus -- have driven stock gains over the last five months.

"I can't say there won't be a pullback, but with most funds trailing the market this year, active managers are going to use the dips to get in," he said.

Start of September: The week ahead is the last full one before the Labor Day holiday and should bring relatively smooth sailing.

With no market-moving profit reports due for release, investors will look for improvement in factory orders, auto sales and both regional and national manufacturing reports.

The week also brings a series of reports on the Labor market that are expected to show unemployment continues to churn higher. Yet, Wall Streeters are already counting on continued weakness in the jobs market, so the reports may not rattle markets much beyond a knee jerk reaction.

Yet, it is the season for selling, with September the biggest percentage loser of the year for the Dow industrials, S&P 500 and Nasdaq composite, according to the Stock Trader's Almanac.

September also tends to bring a bit of a bait-and-switch, according to the Almanac, opening strong in 11 of the last 13 years and then petering out by month end.

Monday: The Chicago PMI, one of the more closely-tracked regional readings on manufacturing, is due in the morning. The index is expected to have risen to 47.2 in August from 43.4 in July, according to a Briefing.com survey of economists. That puts the index closer to the 50 level that indicates growth in the sector.

Tuesday: The Institute for Supply Management releases its August manufacturing index shortly after the start of trading. ISM manufacturing is expected to have risen to 50.2 from 48.9 in July, pushing the closely-watched report above the key level that indicates expansion.

Construction spending is expected to have fallen 0.2% in July after rising 0.3% in June, according to economists' forecasts. The Commerce Department report is due shortly after the start of trading.

August truck and auto sales are also due in the afternoon.

Wednesday: Payroll services firm ADP releases the August report on private-sector employment in the morning. Employers are expected to have cut 246,000 jobs from their payrolls after cutting 371,000 in the previous month. The report is a precursor to the bigger government non-farm payrolls report due Friday.

Also, outplacement firm Challenger, Gray & Christmas will report on the number of announced job cuts in August.

July factory orders are expected to have risen 1.5% after showing a surprise rise of 0.4% in June. The Commerce Department report is due shortly after the start of trading.

Also on tap: a revision on second-quarter productivity, the minutes from the last Federal Reserve policy meeting and the weekly crude oil inventories.

Thursday: Throughout the morning, the nation's chain stores will be releasing August sales at stores open a year or more. Investors will be looking to see if improvements in the stock market and in the recent economic news have had an impact on so-far sluggish consumer spending.

The Institute for Supply Management's services sector index for August is due shortly after the close of trade and is expected to have risen to 48 from 46.4 in July.

The weekly jobless claims report from the Labor Department is also due shortly before the start of trading.

Friday: The Labor Department releases the August employment report. Employers are expected to have cut 225,000 jobs from their payrolls after cutting 247,000 in July.

The unemployment rate, generated by a separate survey, is expected to have risen to 9.5% in August from 9.4% in July. ![]()