Global oil demand ready to rebound

International Energy Agency says the world's thirst for crude could be revived next year as the global economy recovers.

NEW YORK (CNNMoney.com) -- World oil consumption will rebound next year as the global economy recovers from a deep slump, according to a report released Friday.

The Paris-based International Energy Agency said it expects global oil demand to grow 1.7% in 2010 to an average 86.1 million barrels per day. That's an increase of 350,000 barrels per day from its previous estimate.

Crude for November delivery rose 8 cents and settled at $71.77 a barrel. Oil prices had slipped earlier in the session as the U.S. dollar recovered some ground on speculation that the Federal Reserve could tighten monetary policy as the economy recovers.

In its monthly oil market report, the IEA said "buoyant economic activity in more oil intensive emerging countries" will help support demand next year. However, the group warned that next year's economic outlook "is still fraught with uncertainty."

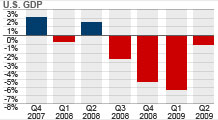

Global oil demand in 2009 is expected to average 84.6 million barrels per day, according to the IEA. That's up 200,000 barrels per day from last month's forecast. But overall consumption in 2009 is still expected to be down 1.9% versus the year before.

Oil surged more than $2 in the previous session as the dollar fell to a 14-month low and a surprise profit from aluminum producer Alcoa (AA, Fortune 500) on Wednesday boosted economic recovery hopes.

The dollar rebounded Friday after Fed Chairman Ben Bernanke said late Thursday that the U.S. central bank could reverse its easy money policies as economic conditions improve to ward off inflation.

"My colleagues at the Federal Reserve and I believe that accommodative policies will likely be warranted for an extended period," Bernanke said. "At some point, however, as economic recovery takes hold, we will need to tighten monetary policy to prevent the emergence of an inflation problem down the road."

The greenback was up 0.3% against the euro to $1.4755. It gained 0.5% versus the British pound to $1.5993. Against the Japanese yen, the dollar rose 0.4% to ¥88.74.

Crude often falls when the dollar strengthens because a more robust greenback makes commodities priced in dollars more expensive for overseas buyers. ![]()