Stocks: Buyers 'swooping back in'

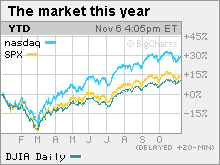

Wall Street lost a mere 6% in the fall selloff before bouncing back last week. Can it keep the ball rolling in a challenging week ahead?

NEW YORK (CNNMoney.com) -- So was that it? Is the so-called market correction over?

Stocks rallied last week, with the Dow reclaiming 10,000, as the major indexes erased most of the losses of the previous two weeks. With the week ahead light on economic and corporate news, market direction will be fueled mostly by momentum and emotion.

"For a while, it looked like we were having a buyer's strike, but then the buyers came swooping back in at the end of the week," said Timothy Ghriskey, chief investment officer at Solaris Asset Management.

After rallying 63% from its 12-year low hit in March, the S&P 500 shed nearly 6% in the last two weeks of October. Some feared the pullback would extend to 15%. Instead, buyers jumped back in.

"The looming issue is whether we've seen enough of a correction to bring out even more buyers or whether we need to see a bigger leg down first," Ghriskey said.

A combination of trillions still sitting in money market funds in either cash or low-yielding cash equivalents makes the case for another run up. Slowly improving economic and corporate news should help as well. But as Friday's labor market report made clear, the economic recovering is still in its infancy.

Jobs and the consumer: Last week's run was fueled by better-than-expected profit and economic reports, the government's decision to extend unemployment benefits and the homebuyer tax credit -- and news that Warren Buffett's Berkshire Hathaway (BRKA, Fortune 500) bought railroad Burlington Northern Santa Fe (BNI, Fortune 500).

But even bad or mixed news on the jobs front got rewarded last week, most notably on Friday, when stocks managed to gain despite a government report showing unemployment hit a 26-year high of 10.2% last month.

The knowledge that the labor market is the last area to turn in a recovery and that the unemployment rate would eventually top 10% may have taken the sting out of the report, Ghriskey said. Or there may be the perception that the 10.2% rate was as bad as its going to get.

Either way, the willingness of investors to respond to both good and bad news by jumping in and buying suggests the mood has turned more positive again -- whether it should or shouldn't.

Wall Street saw its biggest one-day rally in three months after the weekly jobless claims dropped to 512,000, a level not seen since January. Yet, the decline could mean people are running out of benefits, rather than finding jobs. And unemployed or underemployed consumers don't spend aggressively -- problematic for a recovery.

"At some point soon we need to start seeing improvement rather than just better-than-expected news," said Mike Stanfield, chief investment officer at VSR Financial Services.

"Even if the news continues to improve it's reasonable that stocks will seesaw for the next few months until the economic news starts to show stronger growth," he said.

Monday: This week brings the quarterly refunding from the Treasury Department. Treasury issues $40 billion in 3-year notes Monday, $25 billion in ten-year notes Tuesday and $16 billion in 30-year bonds Thursday.

Tuesday: The Senate Budget Committee holds a hearing on bi-partisan efforts needed to cut the deficit.

Bank of America's financial services conference begins in the morning, with outgoing CEO Ken Lewis due to speak.

Wednesday: Treasury bond markets, government offices and some banks are closed for Veterans Day, but all other financial markets are open.

After the close of trading, Applied Materials (AMAT, Fortune 500) reports quarterly results. The chip gear maker is expected to have earned 3 cents per share versus 18 cents a year ago, according to analysts surveyed by Thomson Reuters.

Thursday: Wal-Mart Stores (WMT, Fortune 500) reports results before the start of trading. The Dow component is expected to have earned 81 cents per share versus 77 cents a year ago, according to forecasts.

Walt Disney (DIS, Fortune 500) reports quarterly earnings after the close. The media company is expected to have earned 40 cents per share versus 43 cents a year ago.

Government readings on weekly jobless claims, weekly crude oil inventories and the October Treasury budget are also due in the morning, but forecasts weren't available in advance.

Friday: The September trade balance is due out before start of trading. The trade gap is expected to have widened to $31.9 billion from $30.7 billion in the previous month, according to a consensus of economists surveyed by Briefing.com.

The University of Michigan's consumer sentiment index for November is expected to have risen to 71.8 from 70.6 in the previous month.

JC Penney (JCP, Fortune 500) is due to report results before the start of trading. The retailer is expected to have earned 11 cents per share versus 55 cents a year ago.

Abercrombie & Fitch (ANF) reports results before the start of trading. The retailer is expected to have earned 21 cents per share versus 72 cents a year earlier.

Government readings on October import and export prices are also due in the morning, but forecasts were not available in advance. ![]()