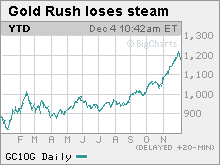

Gold prices fall 4%

Gold prices descend after hitting Thursday's record.

NEW YORK (CNNMoney.com) -- Gold prices fell off their record highs on Friday, falling 4% after a better-than-expected report about the job market lifted investor confidence.

Futures for February delivery slipped $48.80 to $1,169.50 a troy ounce on Friday. This is after gold prices settled at $1,218.30 on Thursday, an all-time high when not adjusted for inflation.

This is a direct consequence of a U.S. government report on Friday that showed the unemployment rate fell to 10% from 10.2% and that job losses are slowing down, said Adam Klopfenstein, senior market strategist at commodities brokerage firm Lind-Waldock. This inspired a stock rally and took the wind out of gold prices, which have been on the rise, with little interruption, since surpassing $1,000 on Sept. 8.

"The gold market got knocked down because [the Federal Reserve is] going to have to raise rates sooner, because the job market seems to be recovering at a faster clip than was anticipated," said Klopfenstein.

The employment report found the U.S. economy lost 11,000 jobs in November. While any job loss is a negative for the economy, this decline was dramatically smaller than expected and was the lowest job loss since the start of the recession. Economists expected a loss of 125,000 for November, according to a consensus of forecasts compiled by Briefing.com.

Gold is a historic repository for funds when times are tough and investors lack confidence in other parts of the market. So gold prices tend to rise when confidence heads south, and the dollar is weak.

"The dollar's up pretty strong today, and when you see a dollar rally, that's bearish for gold," said Klopfenstein.

But while gold prices hit a record on Thursday, they were still a far cry from their real peak, as measured in dollars adjusted for inflation. Gold hit its summit on Jan. 21, 1980, when it peaked at $825.50 an ounce, in 1980 dollars. That translates to an all-time peak of $2,163.62 an ounce in 2009 dollars. ![]()