Search News

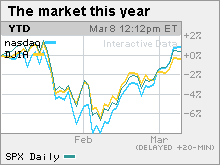

NEW YORK (CNNMoney.com) -- Stocks ended little changed Monday, although the Nasdaq managed to close at an 18-month high, as investors weighed corporate deals, a stronger dollar and weaker commodity prices ahead of key economic news due later this week.

The Dow Jones industrial average (INDU) lost 14 points, or 0.1%. The S&P 500 index (SPX) was little changed. Both ended the previous session at their highest levels since Jan. 20.

The Nasdaq composite (COMP) added 6 points, or 0.3%, ending at its highest point since Sept. 2, 2008.

Stocks rallied Friday after a government report showed the economy lost fewer jobs in February than economists had expected.

But stocks drifted Monday as investors looked to a host of economic news due later in the week, including reports on state-by-state unemployment Wednesday, weekly jobless claims Thursday and retail sales Friday.

Deal news: MetLife (MET, Fortune 500) agreed to buy troubled insurer AIG (AIG, Fortune 500)'s American Life Insurance unit, known as Alico, in a $15.5 billion cash-and-stock deal. The deal was a positive, but not a surprise, as MetLife had confirmed last month that it was in talks with AIG.

It was AIG's second major sale in a week as the government-owned company looks to pay back over $100 billion in bailout money it took during the financial crisis.

MetLife will pay $6.8 billion in cash, with the remainder in company stock. The deal leaves AIG as Met's second-biggest shareholder, with a stake of over 20% in the company. Met shares gained 5% and AIG shares gained 3.6%.

In other deal news, Royal Dutch Shell and PetroChina have made a bid to buy Australia's Arrow Energy for $3 billion in cash and stock. Royal Dutch already owns a 10% stake in Arrow.

Deal news tends to support stock gains in general, as it is seen as a sign of corporate confidence.

Company news: McDonald's (MCD, Fortune 500) said February same-store sales rose 4.8%, as strength in overseas markets offset weakness in the United States. Same-store sales is a retail metric that refers to sales at stores open a year or more. Shares of the Dow component rose 2.3%.

Dubious anniversary: Tuesday brings the one-year anniversary of what many consider to be the bear-market low. On that day, the Dow and S&P 500 closed at 12-year lows and the Nasdaq closed at 6-year lows.

Between March 9 and the 2010 rally high hit on Jan. 19, the S&P 500 gained 70%, the Dow gained 64% and the Nasdaq gained 44%.

World Markets: In overseas trading, European markets slipped and Asian markets rallied.

The dollar and commodities: The dollar gained versus the euro and the yen.

U.S. light crude oil for April delivery rose 37 cents to settle at $81.87 a barrel on the New York Mercantile Exchange.

COMEX gold for May delivery fell $10.90 to settle at $1,124.60 per ounce.

Bonds: Treasury prices tumbled, raising the yield on the 10-year note to 3.71% from 3.68% late Friday. Treasury prices and yields move in opposite directions.

Market breadth was positive. On the New York Stock Exchange, winners beat losers four to three on volume of 920 million shares. On the Nasdaq, advancers topped decliners by seven to six on volume of 2.19 billion shares. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |