Search News

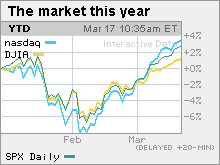

NEW YORK (CNNMoney.com) -- Stocks rallied Wednesday, with the Dow, Nasdaq and S&P 500 all closing at new fresh 2010 highs, after the U.S. and Japanese central banks chose to keep interest rates low and the Senate passed a key jobs bill.

The Dow Jones industrial average (INDU) added 48 points, or 0.6%, closing at 10,733.67. It was the highest close since 10,831.07 on Oct. 1, 2008.

The Dow has now risen for seven sessions in a row, its longest winning streak since the 8-day period that ended on August 27 of last year.

The S&P 500 index (SPX) rose 7 points, or 0.6%, closing at 1,166.21, the highest close since 1,213.01 on Sept. 26, 2008.

The Nasdaq composite (COMP) gained 10 points, or 0.5%, closing at 2,389.09, its highest point since 2,411.64 on Aug. 28, 2008.

Stocks were moderately higher in the morning, but picked up the pace in the afternoon after the Senate passed a key jobs bill and the dollar's weakness sparked a rally in commodity prices and stocks.

Stocks have been moving higher fairly steadily over the last few weeks, with the Dow and S&P 500 rising in 14 of the last 15 sessions and the Nasdaq rising in 13 of the last 15 sessions through Wednesday's close.

The market has been benefiting from a technical breakthrough that should continue to push it higher in the short term, said Ryan Detrick, senior technical strategist at Schaeffer's Investment Research.

"Yesterday, we broke above a key level that had been giving us some resistance and that seems to have brought in new buyers," Detrick said.

He said stocks are moving into what has been a pretty bullish period over the last five years, with the market showing good returns from March through May.

Stock gains Tuesday left the S&P 500 at a fresh near 18-month high, the Nasdaq at an 18-month high and the Dow just short of its 2010 peak. The positive sentiment continued Wednesday, as investors welcomed a report showing that wholesale inflation fell 0.6% last month in the biggest monthly decline since last July.

A sustained period of low pricing pressure would enable the Federal Reserve to keep interest rates low for a while.

Investors also welcomed Japan's decision to hold interest rates at a low 0.1% and double the amount of money available to banks through a short-term lending program.

Rally recharged: Investors found their footing after a selloff in the second half of January and early part of February. However, gains have been modest and trading volume has been low as investors struggle amid a lack of clear catalysts to keep driving the market higher.

Fourth-quarter profits showed strength compared with poor results a year ago, and recent reports have suggested the pace of job losses is slowing. Yet investors are looking for more concrete signs that the economy is recovering to justify a bigger rally after last year's blow out.

In 2009, the Dow gained 19% for the year, and rose 59% from the March 9 lows.

Stocks gained Tuesday after the Federal Reserve opted to hold interest rates steady, as expected, and said rates should stay near zero percent for the foreseeable future. News that ratings agency Standard & Poor's decided not to downgrade Greece's debt helped soothe fears that the euro zone nation could default.

Jobs: The Senate passed a $17.6 billion jobs bill Wednesday and sent it to President Obama to sign it into law.

The measure, which includes tax breaks and funding for highway projects, has been much debated in both houses of Congress over the last few weeks. It is seen as being the first in a series of bills designed to help bring unemployment down from its current level of 9.7%.

Bernanke: Federal Reserve Chairman Ben Bernanke was on Capitol Hill Wednesday afternoon to testify before the House Financial Services Committee about the central bank's supervision of banks. Former Fed Chairman Paul Volcker, an adviser to Obama, also appeared at the hearing.

Pricing pressure low: The Producer Price Index (PPI), a measure of wholesale inflation, fell 0.6% in February for the biggest drop since July of last year after being expected to fall 0.2%, according to a consensus of economists surveyed by Briefing.com. PPI gained 1.4% in January

The so-called core PPI, which strips out volatile food and energy prices, rose 0.1% in the month, as expected. Core PPI gained 0.3% in January.

The dollar and commodities: The dollar gained versus the euro and the yen.

U.S. light crude oil for April delivery roes $1.23 to settle at $82.93 a barrel on the New York Mercantile Exchange.

COMEX gold for April delivery rose $1.70 to settle at $1,124.20 per ounce.

Bonds: Treasury prices rose, lowering the yield on the 10-year note to 3.64% from 3.65% late Tuesday. Treasury prices and yields move in opposite directions.

World markets: In overseas trading, European markets rallied. The London FTSE rose 0.4%, the French CAC 40 rose 0.5% and the German DAX gained 0.9%. Asian markets advanced, with Japan's Nikkei adding 1.2% and the Hong Kong Hang Seng gaining 1.7%.

Market breadth was positive. On the New York Stock Exchange, winners beat losers seven to three on volume of 1.02 billion shares. On the Nasdaq, decliners beat advancers by three to two on volume of 2.23 billion shares. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |