Search News

NEW YORK (CNNMoney.com) -- Is there such a thing as currency vigilantes? If so, do they wear masks like Zorro and leave "$" as their mark?

You've probably heard of the bond vigilantes. It's a term used to describe those who are frustrated with monetary policy and sell long-term bonds as a means to push yields higher.

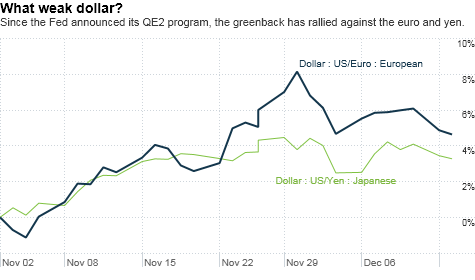

The vigilantes are alive and well it appears. Since last month's launch of the Federal Reserve's widely maligned second round of quantitative easing, or QE2, bond yields have gone up. But so has the dollar.

The greenback has gained about 5% against the euro since the Fed's last meeting on November 3. The U.S. Dollar Index, which measures the dollar against the euro and 5 other major currencies, is also up 5%.

This is a bit of a surprise. Many Fed critics complained that QE2, essentially a program to purchase $600 billion in long-term U.S. bonds, would create artificial demand for Treasuries in order to keep their prices up and rates low.

That could further devalue the dollar, which would be bad news even though a weaker greenback could benefit large U.S. companies that do a big chunk of business abroad. That's because there are larger concerns about how a weaker dollar could lift already high commodity prices and add to inflation pressures.

The Fed's policy-setting committee held its last meeting of 2010 Tuesday. As widely expected, the central bankissued no change to its bond-buying plans and once again held its key interest rate near zero.

But several currency experts think that the dollar's recent rally may soon come to an end. The negative effect on the dollar from QE2 that everybody expected is still going to happen -- just a little later than first thought.

Andrew Busch, global currency & public policy strategist with BMO Capital Markets in Chicago, said that one of the reasons the dollar has held up well since early November -- despite QE2 -- is that speculation has turned to when the Fed may end the program. Several pieces of economic data in the past few weeks point to signs of improvement in the economy.

The labor numbers are the obvious exception though. That's why Busch believes any talk of the Fed stopping QE2 before it completes all the bond purchases is premature.

"QE2 is the be-all and end-all for the direction of the dollar," he said. "The dollar should be soft until there is more robust job growth again and the Fed can feel comfortable ending the program. The economy seems to be growing but the disconnect is jobs."

Michael Woolfolk, senior currency strategist with Bank of New York Mellon in New York, also thinks the most likely direction for the dollar in the next few months is down.

Woolfolk argues that the main reason the dollar held up as well as it did in the immediate aftermath of the Fed's QE2 announcement is because problems in Europe once again took center stage. That led to more investors flocking to the dollar -- and out of the troubled euro -- as a safe haven.

However, fears of a doomsday scenario in Europe have faded somewhat following the agreement to bail out Ireland. So attention should shift back to the United States and QE2.

"Quantitative easing is corrosive to the value of a currency," Woolfolk said. "The dollar strengthened because the impact of QE2 was temporarily derailed by the renewed crisis in Europe. With Europe on the back burner for now, the dollar's value should begin to erode again."

But the problem with predicting just where the dollar will go in the next few months is that there are so many forces at play.

Woolfolk said that based on the fundamentals of the U.S. economy, the dollar should probably weaken against the euro. He predicted that the euro could rise as high as $1.50 against the dollar by the middle of 2011. The euro currently trades at $1.34.

But he added that if Europe sovereign debt fears return with a vengeance, which is hardly an implausible scenario, you could make the case for the euro falling as low as $1.17 against the dollar.

Still, the euro is not the only story when it comes to the dollar.

James Dailey, manager of the Team Asset Strategy Fund in Harrisburg, Pa., said as long as the Fed's QE2 program continues, the dollar should slide against other currencies from emerging markets.

That could put even more pressure on commodity prices like oil and gold and add to the brewing tension between developed nations whose economies are stagnant and developing nations that are trying to fight inflation more vigorously.

Dailey's fund owns a position in the Canadian dollar. He said though that he thinks the U.S. dollar may hold up the best when compared to the euro, British pound and Japanese yen. But that's not saying much.

"People's view of the dollar needs to get more nuanced. So many people pay attention to the dollar index," Dailey said.

"The bigger question is whether the forces causing Western currencies and the yen to go down versus emerging currencies will continue. They likely will," he added.

-- The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney.com, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |