NEW YORK (CNNMoney) -- Gold, oil and other commodities enjoyed a stellar run in 2010. The party may not be over just yet ... but investors have to be wary.

Several experts say that the main forces behind the bull run in commodities last year, namely strong economies in emerging markets coupled with worries about the health of the U.S. and Europe, are likely to remain in place this year.

Concerns about the sovereign debt crisis in Europe and the slow grind of a recovery in the U.S. could weaken both the euro and the dollar. A stagnant greenback in particular should bolster commodity prices since many commodities are priced in dollars.

David Beahm, vice president of economic research Blanchard & Company Inc, a New Orleans-based investing firm that specializes in tangible assets like gold and other precious metals, says gold could hit $1,650 an ounce in 2011. That's about 15% higher than current levels, which are already flirting with record highs (not adjusted for inflation.)

Beahm said that the Federal Reserve's quantitative easing program should lead to more weakness for the dollar as the central bank continues to purchase long-term bonds. He added that the Fed may need to do even more to jumpstart the economy, especially if the unemployment rate remains high.

That could create more long-term inflation fears, which could fuel another spike in gold and other metals. Gold is often used as a hedge against inflation.

"The economic improvement in the U.S. is not as rosy as you might think. The Fed is going to have to continue printing money and that makes gold extremely attractive," Beahm said.

At the same time, the robust economic growth in China, India, Brazil and Russia should lead to more demand for oil, industrial metals like copper and palladium and agricultural commodities like wheat and corn.

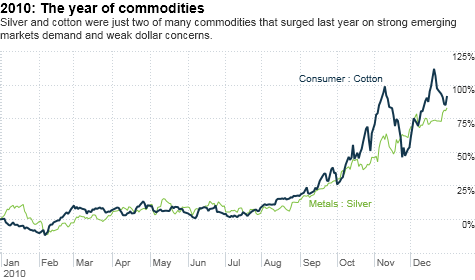

Still, it's important to remember that some commodities ran up so much last year. Silver surged 80% in 2010 while cotton and wheat both shot up over 90%. That may make a repeat performance for these commodities in 2011 impossible, even if the so-called BRIC nations continue to consume like mad.

"Emerging markets helped drive demand for commodities across the board so we are still bullish on commodities," said Oliver Pursche, co-manager of the GMG Defensive Beta Fund in Suffern, N.Y. "But investors have to be careful at these levels. If you expect returns like 2010, you're likely to be disappointed."

Pursche said that prices for many of the metals are ahead of themselves. He said that the only one that still appears attractive based on true supply and demand issues is palladium. He added that energy-based commodities, such as oil and coal, also have room to run.

Doug Ober, CEO of Petroleum & Resources Corporation (PEO), a closed-end fund based in Baltimore that invests in energy stocks, agreed. He said there's only so much that a weak dollar and inflation concerns can do in terms of boosting commodity prices.

Ober said investors need to stick to commodities -- and stocks that benefit from rising commodity prices -- that are tied to assets with real industrial use.

"Gold is more about currency risk," Ober said, adding that as long as China's economy keeps humming along, oil, coal and copper should do well.

But some worry that commodity prices have no room to go but down since so many strategists are predicting strong returns for 2011.

"Every time there is an asset where almost everybody says you should jump on board, that's when people usually get hurt," said David Loeper, chairman and CEO of Wealthcare Capital Management in Richmond, Va.

Loeper said that he thinks the inflation fears are overblown and that there is still a big risk for the U.S. to be mired in a long-term deflationary spiral like Japan in the 1990s. That ultimately would be bad news for commodities.

For all these reasons, Pursche said commodities are not for the faint of heart. He conceded that his fund has nearly a quarter of its assets in commodities, but that it's a multi-year bet, not a means to make a quick buck.

Investors looking to trade in and out need to be extremely careful. Pursche said he would not be surprised if there was a violent pullback sometime this year since he believes many traders have priced in no bad news.

"You could easily have a big sell-off. All it would take is China coming out and raising interest rates by three-quarters of a point instead of just a quarter-point, for example." he said. "There are lots of little events that wouldn't derail the long-term view for commodities but could cause accelerated selling in the short run."

-- The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |