Search News

Click chart for more market data

Click chart for more market data

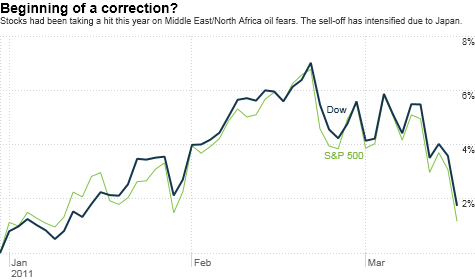

NEW YORK (CNNMoney) -- Beware the Ides of March, indeed. Investors were in full-fledged panic mode Tuesday morning.

Stocks, long-term bond yields and commodities were plummeting. Meanwhile. the VIX (VIX), Wall Street's so-called fear gauge, was surging. It shot up more than 20% at one point.

This all followed the more than 10% drop in the Nikkei Tuesday, as fears about damaged nuclear reactors following Friday's massive earthquake and tsunami continued to grip Japan.

Are investors overreacting? Some strategists don't think so.

The Japan disaster, coupled with the political turmoil in the Middle East and Northern Africa, fears about China's economy slowing down and continued fiscal challenges in the United States and Europe, are the ingredients for a long-overdue correction.

The Dow (INDU) fell more than 250 points, or about 2%, early Tuesday morning. The S&P 500 (SPX) and Nasdaq (COMP) were each lower by about 2% as well. Stocks pared their losses as the day progressed though and the major indexes all finished down by a little more than 1%.

But the Dow, S&P and Nasdaq are still up sharply from their bear market lows from two years ago. That means there could be more room for stocks to fall. Simply put, corporate earnings estimates may be way too high, considering all the global worries.

"Japan may be a reason for a sell-off but the larger questions is 'Are strong profits really sustainable?' We would say no," said Nick Tompras, chief investment officer with St. Louis-based Alpine Capital Research.

Tompras said he thinks the broader market needs to fall further -- perhaps as much as 10% to 15% -- before he'd be excited about valuations and look to buy.

Others aren't as bearish but are still predicting more volatility. Tim Courtney, chief investment officer with Burns Advisory Group in Oklahoma City, said he thinks a pullback of about 5% to 10% is more likely.

Courtney said he thinks the market is still in recovery mode and that brief swoons during a bull run are to be expected.

However, he conceded that it's fair to wonder if stocks will drop even more since it's unusual to have a market rally as explosive as the one we've had for the past two years without any major hiccups. Even last year's spring sell-off following the Flash Crash and Europe sovereign debt PIIGS scare was relatively mild.

Courtney added, though, that investors would probably remain skittish for the foreseeable future. He noted that there should still be strong demand for Treasury bonds -- even if Japan is forced to sell some of its Treasury holdings to help pay for damages tied to the catastrophe.

Bond yields and prices move in opposite directions, meaning that bond buying pushes rates even lower. That was happening Tuesday. The yield on the benchmark 10-year Treasury fell to 3.32%, its lowest level since mid-January. A yield of 3% could soon be in sight.

"People in the U.S. are spooked and are more than wiling to buy any bonds Japan is selling off their hands," Courtney said.

Frank Fantozzi, CEO of Planned Financial Services, a wealth management firm in Cleveland, added that market volatility is probably the new norm until the myriad of global concerns subside.

"When there's a crisis, there is always an immediate pullback. Investors tend to become more conservative," he said. "There is a lot of geopolitical risk now and when you factor that in, it should weigh on stocks."

That said, experts say it would be a mistake to pull a Chicken Little and dump everything in your portfolio and rush to cash. Tompras said some safe haven-oriented stocks may still be attractive, such as drugmakers and Merck (MRK, Fortune 500) and Johnson & Johnson (JNJ, Fortune 500) as well as defense contractor Lockheed Martin (LMT, Fortune 500).

Fantozzi noted that manufacturing companies such as Caterpillar (CAT, Fortune 500), as well as materials companies, are likely to be heavily involved in the rebuilding of Japan's infrastructure.

And Courtney said that even commodities, particularly gold, are still worth buying as long as investors don't go overboard. After all, global fears tend to drive up gold and other precious metals as people worry about the greenback and other paper currencies.

"I don't think it's a bad idea to take a small percentage of your portfolio and put it in gold or other commodities. It does seem like that's providing some hedge against a falling dollar," he said. "I wouldn't make it a cornerstone of your investments but it makes sense to have some in there."

-- The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |