Search News

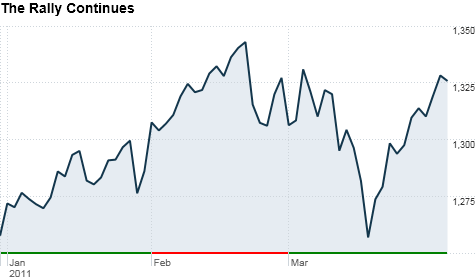

The S&P 500 is up more than 5% this year despite rising commodity prices and ongoing geopolitical turmoil. Click the chart for more market data.

The S&P 500 is up more than 5% this year despite rising commodity prices and ongoing geopolitical turmoil. Click the chart for more market data.

NEW YORK (CNNMoney) -- This week, corporate earnings return to the forefront.

Earnings season kicks off Monday afternoon with results from Alcoa (AA, Fortune 500) and later this week, investors will get results from Google (GOOG, Fortune 500), JPMorgan Chase (JPM, Fortune 500) and Bank of America (BAC, Fortune 500) among others.

With congressional leaders and President Obama reaching a budget agreement late Friday night to keep the government open, the attention should be squarely on corporate profits.

Investors head into one of the most highly-anticipated earnings seasons in years. A weak jobs picture and surging commodity prices have made investors nervous. Profit margins are also beginning to get squeezed after several quarters or rising profitability.

Fred Dickson, chief market strategist with D.A. Davidson & Co., said the earnings conference calls -- when executives typically talk about the future -- may be even more important than the actual results.

"While we expect a fairly good earnings season, the company guidance is going to be key, partially with how commodities have been performing," said Dickson.

Outside of earnings, investors remain focused on the rally in commodity prices - particularly oil. Oil jumped to over $113 a barrel on Friday, rising more than 4.5% last week.

Stocks ended last week mostly lower following the surge in commodity prices.

Opinions on what oil prices mean for stocks are mixed. Dickson said high oil prices may negatively impact both corporate earnings and consumer spending later this year, while others feel high oil prices could help the stock market in the long run because it means the Federal Reserve will continue to keep rates near zero.

"Oil's drag on the economy keeps the Fed from raising short term interest rates," said Bill Vogel, senior analyst with Merlin Securities.

Monday - Aluminum producer Alcoa will release its first quarter results after the closing bell on Monday. Analysts surveyed by Briefing.com expect the Dow component to report a profit of 27 cents a share, up from 10 cents a share last year.

Tuesday - The Commerce Department is scheduled to release the U.S. trade balance for February at 8:30 a.m. ET. China reported a small surplus for March, but a more than $1 billion trade deficit for the first quarter on Sunday.

The Federal Reserve will release its Beige Book at 2 p.m. on Tuesday. The report is a collection of the anecdotal observations about the state of the U.S. economy by the Federal Reserve's 12 regional banks.

Wednesday -- Banking giant JPMorgan Chase is on deck to release its quarterly results some time before the opening bell. Analysts are looking for the bank to earn $1.16 a share, compared to 74 cents a share a year ago.

Investors will get the government's March retail sales report at 8:30 a.m. ET, followed by the business inventories report for February at 10 a.m. ET.

Economists are looking for March retail sales to rise 0.5% compared with the 1% rise in February. Business inventories are expected to increase 0.8%.

Thursday -- The Labor Department is scheduled to release weekly initial jobless claims and the producer price index for March, both at 8:30 a.m. ET.

Wall Street expects initial claims edged higher by 3,000 to 385,000 claims last week while producer prices rose 1% in March.

Google reports its quarterly results after the bell. Analysts expect the Internet search giant's profits will jump to $8.13 share, compared to the $6.76 a share Google earned last year.

Friday -- Dow component Bank of America will report its earnings before the bell, with analysts expecting a profit of 28 cents a share.

Other companies reporting on Friday include broker Charles Schwab (SCHW, Fortune 500) and toy maker Mattel (MAT, Fortune 500).

In economic data, the Labor Department puts out its March consumer price index, one of the primary gauges of inflation. Economists expect March CPI to rise 0.5%.

Also on Friday, investors will get the University of Michigan's consumer sentiment survey for April, industrial production and capacity utilizations figures from the Commerce Department, and the Empire State manufacturing index from the New York Federal Reserve. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |