Search News

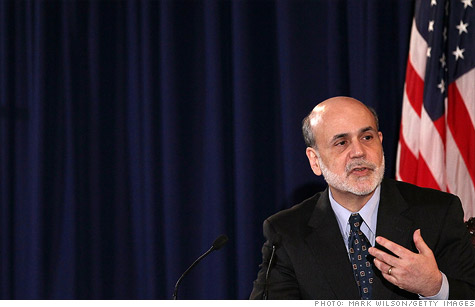

Fed Chairman Ben Bernanke isn't done buying Treasuries, even if QE2 is almost over.

NEW YORK (CNNMoney) -- QE2 is just about done. But the Federal Reserve will still be buying massive amounts of long-term Treasuries.

In fact, the Fed's purchases over the next year will likely be at least $300 billion. That's half the size of QE2 -- even if QE3 never takes place.

Think of it as QE2.5.

While the Fed's efforts to pump about $600 billion of new cash into the economy over the last eight months comes to an end this week, the program, known as quantitative easing or QE2 for short, was not the only way the central bank was an active buyer of Treasuries.

Since last August, the Fed purchased $250 billion in long-term Treasuries in addition to the QE2 purchases. That's because it was reinvesting the principal from other securities that matured.

Assuming the Fed keeps reinvesting, as it said it would earlier this month, it will continue to be a very big buyer of bonds in the months to come.

"We still see the Fed being a major buyer of Treasuries, and giving the market some support," said Kim Rupert, managing director of fixed income for Action Economics.

But those purchases may not push yields, which move in the opposite direction of their price, lower for that much longer.

Rupert said she expects bond yields to rise even with the Fed's continued purchases. She said some investors who bought Treasuries recently in a flight to quality will unwind those positions. If the economic outlook improves later in the year, that could also lift interest rates.

The additional Fed purchases will have an impact though. Rupert said it should "slow the updraft in yields in a measurable way."

The Fed still has more than $1 trillion in mortgage-backed securities, debt issued by government-sponsored firms Fannie Mae and Freddie Mac and other long-term bonds on its balance sheet.

While not all of this debt is set to mature in the next few months, the Fed still has a lot at its disposal to roll over into new bond purchases.

Of course the Fed could decide to stop reinvesting the principal of maturing securities. But that could almost have the same effect of actually raising interest rates. It would take significant amounts of cash out of the economy.

Even though some Fed policymakers are worried about the impact the bond buying has had on the dollar and inflation, the Fed does not seem ready to remove all its stimulus just yet. After all, the central bank did just issue a gloomier forecast for growth and unemployment through the end of 2012.

"Most of us can agree the economy is not going gangbusters and it's not a self-sustaining recovery yet," said David Coard, director of fixed income sales and trading for The Williams Capital Group. "For the foreseeable future, the Fed will have to maintain an accommodative stance. It's the only game in town." ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |