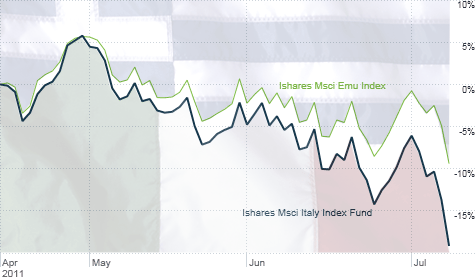

Problems in Greece have hurt all European stocks but shares of Italian companies have been hit harder than the rest of the EMU. Click chart for more on global markets.

NEW YORK (CNNMoney) -- This whole euro debt crisis is starting to remind me of the tagline of "Jaws." Just when you thought it was safe to go back into stocks ... cue the ominous cello music.

Wasn't it only a few weeks ago that investors seemed to think that the worst was over with Greece, Portugal and Ireland? Well, a Greek bailout is still not a done deal. Now there's a dorsal fin with a red, white and green flag on it.

And while Greece, Portugal and Ireland may have been just three little PIIGS-ies (to mix animal metaphors) Italy is not something that the market can gloss over.

Fears about sovereign debt woes spreading to Italy sent stocks around the world lower Monday. The worry is that Italy, much like Greece, is heavily indebted. It needs to get its budget in order.

But that means Italy has to commit to austerity measures -- and it's not clear that the Italian government is willing to do so. There is widespread speculation that Italy's finance minister, who has been championing substantial spending cuts, could be forced out.

"This is the beginning of what will be a serious problem going forward. Italy has to cut its expenditures," said Paul Dietrich, CEO of Foxhall Capital Management, an Orange, Conn.-based firm focusing on international stocks.

There are also concerns about the exposure that large Italian banks have to Greek debt. That caused a massive sell-off on Friday that spilled over into Monday.

Unsurprisingly, these worries have caused the euro to drop sharply versus the dollar Monday. Gold was also edging higher -- as it often does during times of intense geopolitical fear.

Italian stocks that trade in the U.S., such as oil firm Eni (E), sunglass maker Luxottica (LUX) and Telecom Italia (TI), were hit particularly hard. The iShares MSCI Italy Index Fund (EWI), an exchange-traded fund tracking the Italian market, tanked as well.

But how worried should U.S. investors really be as this surreal (dare I say Fellini-esque) Italian drama unfolds? Very. Or as they say in my mother tongue: Molto.

Italy, while technically part of the euro zone monolith, is by itself the world's seventh-largest economy. A debt and banking crisis there would be infinitely more problematic for the rest of the world than a combined collapse of Greece, Portugal and Ireland.

If nothing else, troubles in Italy would confirm the worst-case scenario that many have been predicting since the Greek debt crisis first begin to unfold more than a year ago: namely that Greece would be just the first euro domino to fall.

"The danger is that the problems are gathering momentum," said Frances Hudson, global thematic strategist with Standard Life Investments in Edinburgh, Scotland. "Italy's economic challenges are real because they are very indebted."

Making matters worse is the fact that the market seems to have lost all confidence in the European Central Bank's abilities to get the crisis solved in a timely fashion. That is reminding some of the heady days before Lehman Brothers went bankrupt less than three years ago.

"It's astonishing how Italian bank stocks were crushed. That's worrisome because banks are the best indicator of how a crisis is developing -- just like it was in 2008," said Andrew Busch, global currency & public policy strategist with BMO Capital Markets in Chicago.

In fact, Italian bank stocks plunged so dramatically that Italian regulators even took the bold step over the weekend to institute a partial ban on certain types of short selling in order to keep stocks from falling further.

That's not good. When regulators decide that the problem is not the underlying fundamentals but the big bad speculators and hedge funds, the battle is already lost.

That's also a lesson from 2008. The Securities and Exchange Commission waged war against so-called naked short selling and even temporarily banned short selling of several big financial stocks in September 2008 ... to little avail.

"If the global financial community has no faith in what you are doing, you can use as many Band-Aids as you want to try and slow down the speculators. But in the end, it's not going to work," Dietrich said.

If you are looking for some good news, Dietrich said that the problems in Greece and Italy may not be significant enough to derail growth in China and other emerging markets, particularly in Asia.

But he added that his firm is avoiding stocks and other investments based in Europe and that he is worried about what Europe's woes mean for the United States.

The dire situation in Europe could wind up being a foreshadowing of what would happen in the United States if politicians don't agree to raise the debt ceiling before the August 2 deadline. Hudson said worries about that might actually be the only thing keeping the euro from falling even more than it has against the dollar in recent days.

So can this end without a financial disaster? Hudson said investors want to see swift action from Europe's leaders to make sure that the crisis doesn't become a true contagion that would threaten the economy of the entire euro zone. There is some time. But it is running out.

She said there is a sense of frustration that Greece may now be allowed to partially renege on some of its debt and that the ECB may not be taking the issues in Italy seriously enough.

"As soon as you get phrases like 'selective default,' the market panics. And bureaucrats in Brussels are still talking and just inching towards an agreement," she said, referring to where the European Central Bank is headquartered.

Sadly, that sounds an awful lot like what's going on in Washington too.

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: