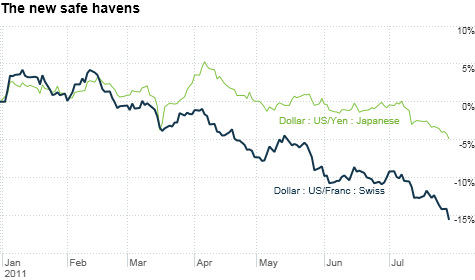

The dollar has taken a beating against the Swiss franc and Japanese yen this year as investors worry about the lack of an agreement to raise the debt ceiling.

NEW YORK (CNNMoney) -- It's getting harder by the minute to find so-called safe havens in this turbulent market.

Stocks fell Friday after the government reported that the pace of economic growth in the first half of the year slowed to a crawl. Making matters worse, there's still no agreement by the nimrods in Washington to raise the debt ceiling.

By mid-morning though, the market had recovered and was essentially flat. Still, the Dow, Nasdaq and S&P 500 are all down about 3% this week.

But take heart weary investors! There are still some pockets of security out there.

The flight to quality is on in gold, the Swiss franc and German stocks. That all makes sense. And one money manager said peanut butter and coffee have a place in your portfolio too. More about that later.

Gold's rally to near a new record high is no surprise. The yellow metal is often viewed less as a commodity and more like an alternative currency. So it often does well when the dollar is in the dumps.

Ditto for the Swiss franc, which has all the benefits of being part of the developed European world without those nasty side effects of that whole EU exposure to the PIIGS thing. The dollar fell to a new all-time low against the Swiss franc Friday.

"The dollar got absolutely hammered due to awful economic data and no progress on a debt deal," said Boris Schlossberg, director of currency research with brokerage firm GFT in New York."The Swiss franc is a safe haven unlike Europe because it has no credit problems and a very sound economy."

Germany, despite being a member of the EU, is also viewed as safe. It is arguably the strongest and most important economy in the euro zone and is home to global leaders like software giant SAP (SAP), industrial conglomerate Siemens (SI) and financial powerhouse Deutsche Bank (DB).

And with continued worries about the U.S. economy slowing down, investors have flocked to German stocks. Fund tracker EPFR Global reported Friday that inflows into German equity funds this past week hit their highest level since the middle of 2008.

But some other safe havens may surprise you, such as the Japanese yen and U.S. Treasury bonds. The yen hit a multi-month high against the greenback.

Japan? Even after the horrible earthquake and tsunami in March? Schlossberg explains that part of the reason is technical. The yen is often used as a funding currency for the so-called carry trade. Investors borrow the yen due to Japan's low interest rates and invest in riskier assets.

Still, Schlossberg said there are some other fundamental reasons why Japan is viewed as a less risky area in the global debt storm. It still has an economy that's driven by exports and is fairly wealthy -- even though it also has an onerous debt load.

The flight to quality into Treasuries is more mystifying at first blush though. Yields fell to about 2.85% on the 10-Year Treasury as investors bought U.S. bonds.

Why are investors still buying U.S. bonds at a time when people are growing increasingly worried that a credit downgrade may take place?

Sure, to paraphrase Casablanca, the cut from AAA to AA is maybe not happening today or tomorrow. But it will probably be soon.

However, even though the U.S. risks getting booted out of the perfect sovereign credit club, many fixed income managers maintain that creditors will continue to view the U.S. as a good risk.

That's because (stop me if you've heard this before) the debt ceiling drama is more of a political crisis than a true financial meltdown like 2008. And that's why yields on long-term U.S. Treasuries are still substantially lower than the likes of Spain, Italy and Greece.

Also, investors tend to buy bonds when economic growth is slow. It may seem paradoxical but even when things appear bleak in the U.S., America remains in better fiscal shape than many other nations around the world.

"For whatever reason, rates keep going lower. We can stroke our chins and speculate about why it's happening. But it is happening. And it's probably going to continue," said John Kosar, director of research with Asbury Research in Chicago.

Of course, that doesn't diminish the valid concerns people have about what might happen if the U.S. actually defaults. But investors also shouldn't panic and dump all their holdings either.

Sandy Villere III, co-manager of the Villere Balanced Fund (VILLX) in New Orleans, La., said some stocks may even remain safe. You just need to find companies with strong balance sheets, preferably those that pay good dividends as well.

And although consumer spending is sluggish, Villere said companies with products that people have to buy regardless of economic conditions are good bets.

He likes auto parts retailer O'Reilly Automotive (ORLY, Fortune 500) for example, arguing that consumers may not want to buy a new car but they will keep fixing their old one. He also said Smucker (SJM, Fortune 500), the company famous for peanut butter, jelly and Folgers coffee, is a good defensive bet.

Villere said that with most stocks being dragged down due to debt ceiling fears, now is a good time to buy.

"When a debt deal finally gets done, people may look back and realize that a lot of companies are lean and mean and had strong earnings," he said.

Schlossberg added that it would be a mistake for investors to rush into the Swiss franc, yen or other currencies that are currently surging. He said that Friday's poor GDP number might be the thing that gets politicians to realize that they have to raise the debt ceiling in order to not make the economy even worse.

And if that happens, he argues that with so many currency traders shorting the dollar, there is a lot of room for it to go up once the lunacy in D.C. finally is over.

"I think we are getting to a point of maximum pain," Schlossberg said. "I think all the parties may soon come to the table and the dollar would rebound because its so grossly oversold."

Reader comment of the week. The debt ceiling craziness has got me in a foul mood. More than usual if that's humanly possible. At one point Thursday, I tweeted that I was "listening to song by Cee Lo Green on Spotify with title that's unprintable here. But you know it. And it's how markets feel about DC now."

My colleague Julianne Pepitone was quick to reply. "What's unprintable about "Forget You"?" she asked.

Well-played, Julianne. And to quote another famous Cee Lo song (with help from Danger Mouse) this is my message to Washington.

"Who do you, who do you, who do you think you are? Ha ha ha, bless your soul You really think you're in control? Well, I think you're crazy."

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: