Search News

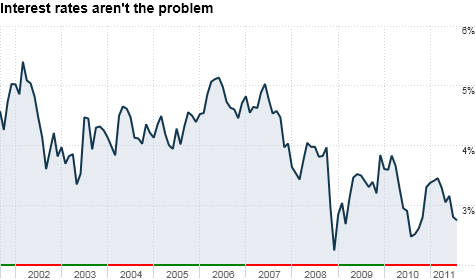

Bond yields are low (and may head lower) because the economy is in lousy shape. Higher rates are often are a sign of a strong economy. Click chart for more on bonds.

NEW YORK (CNNMoney) -- Hooray! It looks like the United States is not going to default on its financial obligations. I think. Interest rates won't skyrocket after all. But oh, wait. What's that? The economy still stinks?

While the debt ceiling compromise is undeniably good news, it's not a cause for raucous celebration. The economy is growing at a clip that's far more tortoise than hare.

Sure, the turtle eventually won the race. But this economy needs some short-term momentum right now, not slow and steady expansion.

The unemployment rate remains uncomfortably high as employers have cut back on the pace of hiring. The housing market is still in shambles. And the manufacturing sector, which had been a bright spot in the first half of the year, is starting to cool off too.

Add that all up and it's no wonder that long-term Treasury rates are continuing to slide. The 10-year Treasury is currently at 2.73%. That's the lowest it's been since last November.

All the worries about interest rates shooting up are in some respects misplaced. Yes, Standard & Poor's and/or Moody's may still wind up downgrading the credit rating of the U.S. And that would put some upward pressure on rates.

But all signs point to the 10 year yield falling even further. As long as the economy remains mired in a slow-to-no growth recovery -- some economists are using the silly term of "growth recession" to describe the current malaise -- not even a downgrade from AAA to AA would do much to change that.

"The impact of a downgrade could be relatively modest. The economic picture is what really is driving interest rates," said Krishna Memani, director of fixed income with OppenheimerFunds in New York. He added that the concerns about the debt ceiling and deficit have been a "sideshow."

Japan is a perfect example of how you don't have to be a perfect credit risk to have bargain basement interest rates. Japan's rated AA by the major agencies and its 10 year bond yields a little more than 1%.

There's little chance that the 10 year yield will fall that low in the U.S. -- or even to the financial crisis bottom of just above 2% from December 2008 for that matter. Experts said the economy would really need to fall into another recession for rates to plummet to those levels.

But make no mistake. They do have room to drop from here.

Robert Tipp, chief investment strategist for Prudential Fixed Income in Newark, N.J., said that it would not be a surprise if the 10-year fell as low as 2.5% in the not-so-distant future. Tipp said that 2.25% isn't out of the question either if the economy continues to languish.

It's also important to remember that rates go down when investors rush into bonds.

Despite the many concerns facing the U.S. economy, Tipp notes that there has still been a "steady flow of demand" for Treasuries from individual investors, pension funds and commercial banks. The worst-case fear of investors dumping our debt is unlikely to be realized.

But you know what? It may not be the end of the world if the Treasury buying binge slows down. Interest rates are extremely low but that's still not enough to stimulate the economy.

Affordability of credit is not the problem. You'd have to be insanely miserly to complain about a 30-year fixed mortgage rate of about 4.5%. The problem is that banks are still reluctant to lend to even the most creditworthy borrowers.

Until banks lend more, it's hard to imagine how the economy will pick up. Rates will stay low as investors buy more U.S. debt.

"Growth will be more modest and fragile. It's going to be at stall speed and always risk not being self-sustaining," said Matt Freund, senior vice president with USAA Investment Management Company in San Antonio. "But the Treasury market is still being viewed as a liquid, high quality safe haven."

If that's the case, that's likely to mean that the stock market will continue to bounce around like a Tilt-a-Whirl. Employers may keep sitting on cash in order to preserve their record profit levels. And the American consumer remains the biggest loser as unemployment stays too high.

While nobody likes it when interest rates are higher, it's easy to forget that higher interest rates are often a sign of a healthier economy. Of course, nobody wants long-term bond yields to shoot up to the double-digit levels in Greece, Spain and other troubled European nations.

Still, there's a happy medium between the super low rates associated with a stagnant economy and the junk levels of the PIIGS. Nobody should root against higher interest rates if it means that investors are willing to take on more risks in a more vibrant economy.

The 10 year was in a range of about 4% to 5% during the housing boom of 2005 and 2006. It was often above 6% in the tech-fueled late 1990s. The difference back then was that the unemployment rate was low and housing prices weren't in free fall.

Those days are distant memories, especially since our "leaders" in Washington seem willing to sacrifice the present in order to focus almost entirely on the deficit.

"The likelihood of a government plan to support the economy now when we are debating raising the debt ceiling and cutting spending is essentially zero," said Memani.

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: