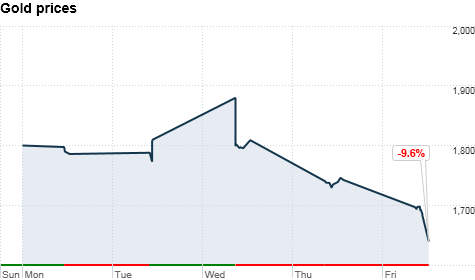

Gold prices plunged this week on more concerns about the global economy. Click the chart for more on gold and other commodities.

NEW YORK (CNNMoney) -- Gold prices continued to plunge Friday, despite the market turmoil that often drives investors to the traditional safe haven.

Gold tumbled $101.90, or 5.9%, in regular trading to $1,639.80 an ounce. It's the second straight day of steep declines for the precious metal.

According to the Chicago Mercantile Exchange, Friday marked the first $100 daily price drop since Jan. 22, 1980, when gold plunged $143.50 to $682 the day after having spiked to a record high.

Keith Springer, president of Springer Financial Advisors, said that while gold has benefited from economic uncertainty in recent months and years, it's primarily been a hedge against inflation.

But the growing worries about a global economic slowdown have raised new fears that there could be a period of deflation, or falling prices, in the months ahead.

"People are quickly coming to the realization that gold does very bad in a deflationary environment," he said.

Gold isn't the only commodity to be hit by concerns about the global economy. Silver suffered its worst trading day in decades losing $6.48, or 17.7%, to close at $30.10.

Copper and platinum also both lost nearly 6%. But those metals have far more industrial uses than gold, Springer said, so fears of a recession should drive down those prices. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: