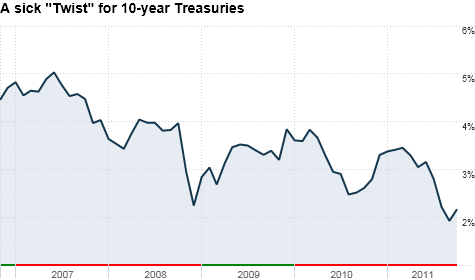

Long-term bond yields are still extremely low. But rates have ticked up since the Fed announced Operation Twist in September. Click chart for more on bonds.

NEW YORK (CNNMoney) -- The Federal Reserve unveiled Operation Twist, its latest attempt to keep interest rates low, nearly three weeks ago. So far, it doesn't seem like the plan is working.

But that may not be a bad thing.

When the Fed announced on September 21 that it would start to sell short-term Treasury bonds and use the proceeds to buy long-term debt, the yield on the 10-year Treasury stood at just 1.88%. A day later, the 10-year plunged to an all-time intraday low of just under 1.7%.

Fast forward to today and the yield is now around 2.17%. While that rate is still ultra-low by historical standards, this is the highest it has been in more than a month.

Can rates keep climbing? And if so, does the Fed need to be nervous?

Bond experts said yields may continue to creep higher -- but not at an alarming rate. And this should not be something for Ben Bernanke to lose sleep over. Here's why.

Long-term bond rates really have no business being this low in the first place. Sure, the Europe debt crisis is unnerving many investors. The slow growth BBQ recovery for the U.S. economy doesn't help matters either. Interest rates typically are low during uncertain economic times. But not this low.

"Economic data in the U.S. is not great, but it's not pointing to a recession yet," said Leslie Barbi, head of fixed income with RS Investments in New York. "The numbers are not strong enough to get yields back above 2.25% but not weak enough to go toward 1.5% either."

Consider that the 10-year yield never fell below 2% in late 2008 or early 2009 -- even though that was at a time of even more heightened fears about the U.S. economy and the global banking system.

Bond investors may have been pricing in a severe double-dip recession (or worse) on a worldwide scale. Investors rushed into Treasuries as a so-called safe haven bet. And all that bond buying pushes yields, which move in the opposite direction of their prices, lower.

But the better-than-expected jobs numbers in the U.S. last Friday combined with growing hopes that Europe is taking the necessary steps to save Greece and European banks, may be pushing deflation and depression predictions off the table.

"The U.S. is likely to experience subpar rates of both growth and inflation for several years," said Steve Van Order, fixed income strategist with Calvert Investments in Bethesda, Maryland. "But the market discounted some really bad news. A 1.7% 10-year yield is not appropriate for just a weak growth outlook."

Van Order said the bond market -- much like stocks -- will continue to be volatile for the foreseeable future. He said investors are going to remain focused on Europe until at least the big G-20 meeting in Cannes in early November.

But as long as the headlines out of Europe become less dire, Van Order thinks rates likely hit bottom a few weeks ago. That's admittedly a big "if" though.

"If we get more good news in Europe and it sticks, the cycle of fear could lead to relief and it would make sense that the 10-year doesn't dive back below 2%," he said. "But if Europe blows it, we could easily be back down to those levels."

Sadly, you can't rule out the possibility that Europe will blow it. With that in mind, the 10-year may remain stuck in its current range for a while.

"Our outlook is sunny with a chance of meatballs. You can still get smacked in the head by something falling. I'm hesitant to get excited," Barbi said.

Others said you can't ignore the Fed's somewhat paradoxical role either.

Some bond investors were aggressively buying bonds before and shortly after the Operation Twist announcement, said John Canavan, an analyst with Stone & McCarthy Research Associates, a Princeton-based fixed income and economic research firm.

Now that Operation Twist is a reality -- the Fed actually began to make long-term bond purchases last week --- Canavan said fixed-income traders are dumping some of their long-term bonds -- especially in light of the jobs report on Friday.

"The market had priced in action by the Fed. But since then, the economic data has turned a little more mixed -- which is a lot better than it had been," Canavan said. "For the 10-year, it could be an easy step to 2.25%."

Canavan added that rates could even go as high as 2.5% if double-dip fears start to wane and there is more confidence in Europe's ability to contain any problems tied to Greece and recapitalize the continent's banks.

And that's the reason that investors should not blast the Fed if the 10-year continues to move up a bit. Keep in mind that rates are still not anywhere close to being prohibitively high.

"If rates rise because the U.S. outlook gets better and there is improving sentiment regarding the European debt crisis, then Operation Twist is not a failure. Even if the the 10-year gets back to around 2.5%, that's still low," Van Order said.

This Twitter feed goes to 11. Thousand. Thanks to the market's recent mini-rally, the Dow is a couple of hundred points higher than my Twitter follower count. But like the Dow, I am now (at the time I wrote this) above 11,000. Hooray!

I promised a shout-out in today's Buzz to whomever signed up as the lucky number 11K. Andy Gauthier, come on down! Your Twitter bio says, "Play like a champ. Win like a champ. Act like a champ." You are a champ to me.

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: