Search News

Herman Cain's proposal to throw out payroll and estate taxes and reduce federal income and corporate tax rates won't get rid of many other taxes Americans pay.

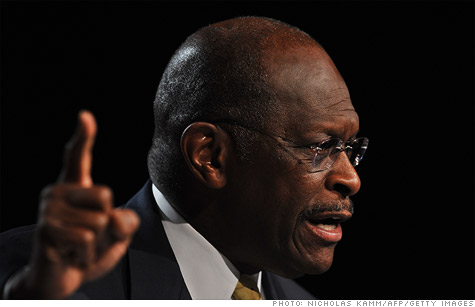

NEW YORK (CNNMoney) -- Herman Cain's tax proposals have rocketed him to the top of the pack in the fight for the Republican presidential nomination.

But while his now-famous 9-9-9 tax plan would scrap the current tax structure in favor of a more simplified system, $90 billion in various federal taxes and fees would still be left intact.

That includes excise taxes on things like gas and alcohol, tobacco and firearms, airline tickets and phone service.

The revenues these taxes generate are no small sum -- equal to nearly half the money now collected in corporate income taxes.

That's one way Cain claims his "9-9-9" tax plan -- consisting of a 9% flat income tax, a 9% corporate income tax and a 9% national sales tax -- would raise just as much money as the current combination of income, corporate and payroll taxes.

Here's a list of taxes and fees you'll still be paying under Cain's proposal, and how much was collected under each in the fiscal year ending Sept. 30, 2010.

Gasoline taxes: The 18.4 cents per gallon contributed about $35 billion to the highway trust fund, the largest amount collected by any of the taxes that Cain's plan would leave in place.

The gas tax had been set to expire on Oct. 1 before Congress approved a six-month extension in the middle of last month. Some Tea Party activists had advocated letting it expire.

But some business groups, including the U.S. Chamber of Commerce and Dan Akerson, the CEO of General Motors (GM, Fortune 500), have advocated for a higher gas tax, both as a source of funding for highway repairs and a way to get Americans to consider buying higher-mileage cars the automakers will soon be required to produce.

Airline taxes and fees: Passengers now pay a 7.5% excise tax on flights, while the airlines pay a variety of fuel taxes. Those taxes and some ticket fees together raise about $13 billion a year that goes to the FAA.

In addition, passengers pay a variety of other fees that raise about $3.4 billion for the Department of Homeland Security. Together with the excise taxes, all these charges can add about $60 to the cost of a $240 domestic airline ticket, according to the Air Transport Association, the industry's trade group.

When a deadlock in Congress temporarily ended the airlines' authority to collect some of those fees in August, most hiked the cost of their tickets by an identical amount and passengers saw no savings.

Alcohol, tobacco and firearms. The government doesn't break down an additional $21 billion collected from "other" excise taxes. But most of that pile of money comes from taxes on alcohol, tobacco products and firearms.

The taxes range from about a nickel on a 12-ounce can of beer to $2.14 for a 750 ml bottle of hard liquor. Smokers pay between $1.01 to $2.11 per pack on cigarettes and small cigars.

Buyers of pistols and revolvers pay an excise tax equal to 10% of the purchase price, while they pay 11% for other firearms and ammunition purchases.

Phone taxes: The Universal Service Fund is funded through taxes on telecom companies that are typically passed onto phone customers. It collects $9 billion a year in order to help those who might otherwise be priced out of service have access to phones and Internet.

It subsidizes rural phone service and makes discounts available to low-income customers. It also helps pay for Internet connections for public schools and rural health clinics.

Other fees and taxes: The government also collects fees and royalties for federal land use for all sorts of things from livestock to gold. Those can range from $1.35 per animal per month for grazing on federal lands, to royalties for oil, gas and precious metals collected on federal lands.

Most of that revenue came from oil, natural gas and coal extraction, which totaled about $7.9 billion in 2010. Other fees added about $3 billion more.

One other major source of income for the federal government isn't exactly a tax, but it would also remain in place under Cain's plan. The Federal Reserve returns any profits it makes to the federal government, much of it coming from interest paid on its massive holdings of U.S. Treasuries.

And because the Fed has purchased trillions in assets in the last three years in an effort to help the economy, those profits have been huge -- last year the Fed returned a record $76 billion to the treasury. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |