Search News

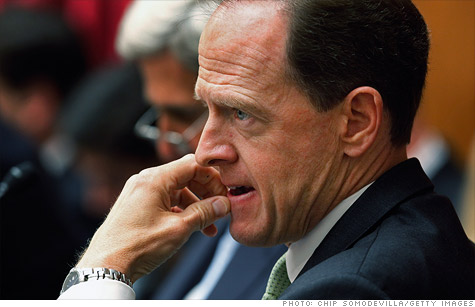

Republican Sen. Pat Toomey put out a debt-reduction proposal that would increase tax revenue by at least $290 billion, a switch from many Republicans' stance that tax increases are verboten.

NEW YORK (CNNMoney) -- Love it or hate it, the debt-reduction plan put forth by Republican Senator Pat Toomey has opened the door to tax increases in the negotiations of the Congressional debt committee.

Many top Democrats rejected it, saying that the door isn't open nearly wide enough.

But the Senate's No. 2 Democrat -- Dick Durbin -- took a broader view. Without endorsing the Toomey plan, Durbin said it could be the "breakthrough" needed to end the deadlock.

That's because it's the first time a Republican member of the debt committee has proposed that tax increases be part of the plan to achieve at least $1.2 trillion in debt reduction. That's the minimum target the committee must meet by Nov. 23. If it fails to, the law calls for automatic spending cuts in 2013.

And importantly, Republican leaders back the Toomey plan, aides told CNN.

It comes less than a week after House and Senate Republicans were sending mixed messages about their position on tax increases.

The plan would reduce deficits by roughly $1.4 trillion over 10 years, according to a Republican aide.

Roughly $400 billion of that would come from additional tax revenue.

However, $110 billion of that is assumed to come from the "benefits" of tax reform -- namely, economic growth and greater compliance, which are difficult to forecast. So only $290 billion of the $400 billion might be considered an "increase" in terms of what taxpayers would pay.

The estimate is a far cry from the $800 billion in additional tax revenue that House Speaker John Boehner proposed during the debt ceiling negotiations this summer with President Obama .

But it's also a big shift from the near-religious stance most Republicans have adopted that tax reform be revenue neutral -- that is, raise no more revenue than the current code would.

Toomey's plan would reform the tax system in two big ways:

First, it would reduce all six income tax rates by roughly 20%. So the top rate would fall from 35% to 28%, and the bottom rate would fall from 10% to 8%.

Second, Toomey would impose a cap on itemized deductions so the total amount of deductions a taxpayer claimed would not exceed a certain percent of adjusted gross income.

Capping deductions would bring in revenue to offset the loss that comes from lowering rates.

The cap would be "aggressive," the aide said.

Democrats, in memo obtained by CNN, said the plan would benefit the rich because of the lower tax rates. The aide countered that high-income households benefit the most from itemized deductions, so any curb on those deductions would also heavily affect those households.

"On average [high-income households] will pay more than they do today," the aide said.

Without a detailed plan and a nonpartisan third party analysis, it's impossible to referee that dispute. There are too many unknowns.

For instance, which deductions would be counted under the cap and which would be exempt? And how high would the cap be set?

Also, which benchmark would the Toomey plan be judged against?

Assuming current policies like the Bush tax cuts stay in effect, the Toomey plan would likely raise more revenue.

Against current law, which assumes the Bush tax cuts expire, the Toomey plan would be a tax cut. However, most lawmakers -- Democrats and Republicans -- consider the current-law baseline to be unrealistic.

In any case, politically and practically, the Republicans' opening bid isn't high enough, said Maya MacGuineas, president of the nonpartisan Committee for a Responsible Federal Budget.

"The revenue number is far short of what's needed to get a deal," MacGuineas said. "But that revenue is on the table is incredibly encouraging.

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |