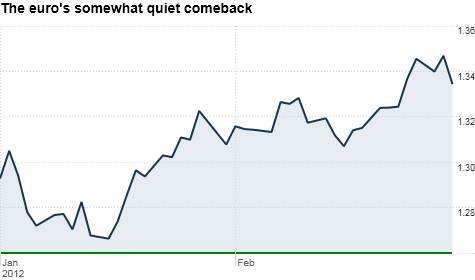

The euro has gained ground against the dollar in 2012 but analysts think the shared currency may be due for another tumble soon.

NEW YORK (CNNMoney) -- The euro is "The Artist" of currencies. It's winning raves and is the feel-good hit of the season! Don't laugh, but the euro has quietly (get it?) enjoyed a nice bounce in the past few weeks. It's up about 6% versus the dollar since mid-January.

But like "The Artist," the euro may be a bit overrated. (Sorry. I enjoyed the movie but is it something that's really worthy of Best Picture?) Several experts think that the euro, now trading around $1.335, has a lot more downside than upside in the coming months.

We've seen this movie with the euro a bunch of times already. It usually doesn't end well. The euro is rallying on that funny little "less bad" phenomenon.

Things aren't as gloomy as once thought. That's not the same thing as saying that the debt crisis in Europe has finally reached a favorable conclusion.

Yes, fears have begun to wane about the wrath of Zeus raining down on Greece ("Release the Kraken!") following the news of the latest Greek bailout.

And the European Central Bank has done its best to restore some confidence in the financial system with two rounds of cheap loans to banks. The second-such Long-Term Refinancing Operation, or LTRO, was met with high demand on Wednesday.

Still, the latest Greek bailout and second round of LTRO (just don't call it QE!) may only temporarily stop the bleeding. Greece remains heavily in hock, as do the much larger nations of Spain and Italy.

Europe is still searching for longer-term solutions to the chronically high levels of debt and sluggish economic growth. The latter may only get worse with budget cuts and higher taxes that are the hallmark of austerity.

"The only reason the euro has increased lately is there hasn't been as much bad news. But it's just a matter of time before that resurfaces. Europe is only prolonging its problems," said Stephen Hammers, chief investment officer of Compass EMP Funds in Brentwood, Tenn.

Hammers, whose funds are currently shorting the euro, said he thinks the euro could fall to as far as $1.10 versus the dollar over the next year as debt woes return to the forefront.

That's a bleak forecast. Other experts aren't that bearish ... but they're not exactly singing the praises of the euro either.

"People should still be worried about the euro," said Guido Schulz, global head of strategic management at AFEX, an international payment solutions company in Encino, Calif.

"You hear a lot about Greece getting expelled or going back to the drachma. I don't think that will happen immediately, but given the austerity measures, the danger is still there," he added.

Schulz said the euro is likely to weaken further over the course of the year if the Greek crisis rears its ugly head again. Still, even if that happened, he doesn't think the euro will fall much lower than $1.20. One reason for optimism? China.

China has already shown a willingness to diversify much of its sovereign portfolio beyond dollar-denominated assets like U.S. Treasury bonds. And while Europe may not be the safest game in town, it's more liquid than smaller emerging markets with higher growth potential.

"China is likely to continue to invest heavily in Europe because it does not want to be that dollar dependent. So even if the euro falls, the decline should not be catastrophic," he said.

There's also the fact that China has a vested interest in helping Europe avoid a truly horrific recession since the eurozone is the largest consumer of Chinese exports.

Still, none of this should be viewed as an endorsement of the euro. Jamie Coleman, chief currency analyst at ForexLive.com in Boston, said the euro has likely peaked for the short-term. He thinks the euro will slide back toward $1.30 in the next few weeks and remain there for awhile.

Simply put, it will take a lot more than avoiding Armageddon to keep the euro rallying. Investors will probably once again look more to currencies in regions of the world that are growing more quickly, like the U.S. and China.

"The ECB has done a great job of taking the risk of catastrophic bank failures off the table," Coleman said. "The odds of a really disastrous European crisis are much lower now than a few months ago. But we know that. The good news is already out there."

Best of StockTwits: Momentum stock darling SodaStream (SODA) plunged Wednesday despite reporting better-than-expected earnings And the sun continues to set on First Solar (FSLR) after a poor earnings report.

activetrading: $SODA its a like I said.... these will all be available at Garage sales a year from now when the novelty wears off

I know some people swear by how good their home-made carbonated beverages are. But I think a lot of people are worried this is a fad. That may be one reason why short sellers have routinely feasted on the stock.

Plus, the stock was trading around 30 times earnings estimates before it uh, lost some fizz, today. Still, maybe it's worth it?

Jettson12: no pos, but $SODA is exp to grow 30x so 30x eps is warranted. The ? is can they hit their numbers

That is the question. So far, SodaStream has done a good job. But as I pointed out in today's Buzz video, you need more than just a few quarters of strong growth before you deserve the kind of hype normally reserved for something like Apple (AAPL, Fortune 500).

bradloncar: This is about that time that $FSLR should have been making good money, not losing it. Solar has been such a disappointment.

Solar still has promise. But the competition from China is brutal. And the European debt situation isn't helping either since even "healthy" European nations like Germany are cutting back on subsidies.

JFinDallas: $FSLR is going to be downgraded across the board by Wall Street in AM, it will probably mark start of the bottoming process, usually does...

Heh. Analysts often do downgrade a little too late. But First Solar still looks risky. It's hard to call a true bottom for a stock when earnings estimates are continuing to drop. You know what they say about trying to catch a falling knife. Or solar panel.

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: