Search News

NEW YORK (CNNMoney) -- The Federal Reserve sounds a bit more upbeat about the job market and the global economy, but still the central bank is erring on the side of caution.

Following a meeting on Tuesday, the Fed's key policymaking committee voted to make no changes to its ongoing stimulus programs.

The central bank still plans to keep the federal funds rate at record lows "at least through late 2014." The Fed has held interest rates near zero since December 2008, hoping cheaper access to credit would spur economic growth.

Meanwhile, the program known as Operation Twist remains in place, shifting $400 billion from short-term to long-term bonds. The hope is that this program will bring down long-term interest rates on everything from car loans to mortgages.

With all these stimulus measures playing out, the Fed is still counting on sluggish economic growth this year. But policymakers did acknowledge some improvement, particularly in the job market.

"Labor market conditions have improved further; the unemployment rate has declined notably in recent months but remains elevated," the Fed noted.

Those comments were no surprise, after the Labor Department reported on Friday that employers have been adding at least 200,000 jobs each month since December. The unemployment rate remained at 8.3% for the second month in a row.

Now markets and Fed watchers are wondering, if the strong job growth continues, will the central bank change its game plan for the recovery?

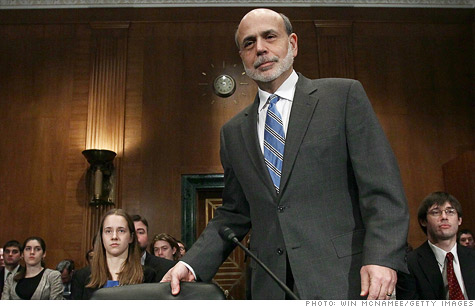

Fed Chairman Ben Bernanke seems reluctant to give any hints on that front just yet. As he pointed out before Congress two weeks ago, recent economic data has given off conflicting signals. Though job market indicators are improving, gross domestic product is still coming in weak.

Plus, the housing market is still slumping, Europe's debt crisis lurks in the background, and rising oil and gas prices remain a risk to consumer spending and inflation in general.

"The recent increase in oil and gasoline prices will push up inflation temporarily, but the Committee anticipates that subsequently inflation will run at or below the rate that it judges most consistent with its dual mandate," the Fed said. The central bank aims for an inflation rate around 2% a year, after stripping out energy and food prices.

The Fed also noted that worldwide financial strains have "eased", although they still pose a "significant downside risk" to the economic outlook.

"That's fairly significant," said Doug Porter, deputy chief economist at BMO Capital Markets. "The fact that they left in the caveat that they still think it poses significant downside risks, means they haven't completely let down their guard down yet, but the Fed is recognizing that the European crisis is no longer the threat it once was to financial markets."

As he did last month, Richmond Fed President Jeffrey Lacker dissented against the Fed's decision Tuesday. He believes the economy will not need ultra-low interest rates as far out as late 2014.

The Fed's next meeting is at the end of April.

Are you a saver or a retiree living on a fixed income? We want to hear how ultra-low interest rates have changed your saving habits or retirement plans. Email us your name and phone number and you could be featured in an upcoming story on CNNMoney. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |