Search News

An ETF of home builder stocks is trouncing the broader market. But that may not necessarily mean housing has bottomed. Many of the stocks in the ETF are NOT builders.

NEW YORK (CNNMoney) -- When is a homebuilder not a homebuilder? When it's in an index of homebuilder stocks, of course!

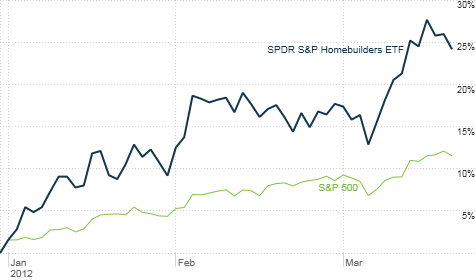

The SPDR S&P Homebuilders (XHB) exchange traded fund has surged this year, leading many to speculate that the housing market has really, honestly, we're not fooling around this time, cross our hearts and hope to die, bottomed.

The builders ETF is up a stunning 26% already this year. But here's the thing. A big chunk of the companies in the fund that are doing well are not really builders.

Shares of Select Comfort (SCSS), manufacturer of the popular Sleep Number beds, is up more than 50% this year. It makes up 3.3% of the fund's assets.

The ETF, which tracks the S&P Homebuilders Select Industry index, also includes many companies that have ties to the housing market, but whose fortunes may be improving for reasons beyond what's going on with real estate in the U.S.

Consider Whirlpool (WHR, Fortune 500). The appliance manufacturer makes up about 3.5% of the ETF's weighting. Shares are up more than 60% this year. But is it really because of optimism about the U.S. housing market?

Nearly half of Whirlpool's revenue in the fourth quarter of 2011 were from outside of North America. What's more, the company's forecast of 0% to 3% growth in unit shipments in the U.S. is slightly below Whirlpool's growth projections for Latin America and Asia. And on Monday, Whirlpool announced a distribution partnership with a leading retailer of home appliances in China.

Several other top-performing companies in the builder index that aren't really builders also generate a decent chunk of change from outside the U.S.

Pillow and mattress maker Tempur-Pedic (TPX) had nearly 30% of its sales from international markets last year. The stock is up nearly 60% this year. Air conditioner and furnace maker Lennox International (LII) also generated about 30% of its total sales from outside the U.S. in 2011. Shares are up 24% in 2012.

"The funny thing about ETFs is that you do have to look and see what's actually in them," said Lance Roberts, CEO of Streettalk Advisors, an investment management firm in Houston.

There are also many retailers in the builders ETF. (You won't find builders in any retailer ETF though.) And while some of these chains, like Home Depot (HD, Fortune 500) and Lowe's (LOW, Fortune 500) in particular, benefit from new home construction and an increase in home buying in general, others aren't that closely tied to the housing market.

In fact, some home retailers, such as Bed Bath and Beyond (BBBY, Fortune 500), Williams-Sonoma (WSM) and Pier 1 Imports (PIR), may be doing well when consumers want to spruce up their current abode -- which may even be an apartment they are renting. Those three companies collectively make up more than 10% of the "builders" ETF.

Retailer Aaron's (AAN), which leases furniture and electronics, is also in the builders ETF. If anything, Aaron's is a countercyclical housing indicator. The company, which lets consumers rent goods until they can afford to own them, did pretty well during the housing bust and Great Recession.

Heck, even iRobot (IRBT), the maker of the Roomba vacuum, is a component of the builder ETF, making up about 3% of the fund's weighting.

It is a huge stretch to put the company in this type of index. For one, 40% of its sales come from industrial and government contracts. And 70% of its home robot sales are in international markets.

Of course, there are many builders in the fund too. Ryland Group (RYL), Lennar (LEN), MDC Holding (MDC) and D.R. Horton (DHI, Fortune 500) are among the top ten holdings. Those stocks have done extremely well this year. But the jury is still out on whether the housing market really can sustain a turnaround.

Sure, building permits were up last month and builders are optimistic. But foreclosures made up nearly a quarter of all home sales in the fourth quarter of 2011 and housing prices hit a nine-year low that quarter as well. And keep in mind that this is despite the fact that mortgage rates are near record lows.

So if you track the homebuilders ETF closely in order to try and predict whether housing is on the mend, just be careful.

While you are getting exposure to real builders, many of the stocks in the ETF may also be beneficiaries of strength in emerging markets and increased demand for consumer goods with relatively small price tags

Just because more people in China are buying refrigerators and more U.S. consumers may be buying a new toaster oven at Bed Bath & Beyond, does not mean that this is a new real estate renaissance.

"I'm not bearish but I am realistic. We may be bouncing off the lows but it's hard to call this a rebound. Every year for the past few years, there have been hopes of a recovery. But housing is still near the bottom," Roberts said.

Best of StockTwits: Diamonds are an investor's best friend. For now. And don't always bet on black ... clothing.

retail_guru: China is 12% of Tiffany sales; well below other #luxe brands at 30%. That IS big $TIF opportunity as awareness is high, availability isn't

RyanNinz: $TIF 71.5 up 4% misses on eps, higher costs, but optimistic abt 2012. Why wouldn't it be "optimistic?" Everyone else is until they aren't

Investors were clearly overlooking the earnings miss from Tiffany (TIF). The stock was up 7% on the jeweler's healthy outlook. But as retail_guru points out, guidance is only healthy if Tiffany delivers in China. And as RyanNnz says, rising expenses could be a concern the company is underestimating.

activetrading: $KORS So they are selling 1 billion of insider stock while pumping up their forecasts? And they throw in ifs and buts? uh-huh.... no thanks.

firstadopter: Dear $KORS you're 1st co ever that I've seen that raises guidance then later in same paragraph says "oops we might not hit guidance" Lame

Michael Kors (KORS) has been one of the hottest IPOs of the past few months. Shares have more than doubled since they debuted in December. So it's only natural that insiders would sell a bit more. But this should serve as a reminder to any IPO investor. Always be prepared for an eventual secondary offering that could dilute the value of the shares owned by the people that bought early.

As for the hemming (ha!) and hawing on guidance, that's a bit odd. Michael Kors wouldn't tolerate a "hot mess" from one of the contestants on "Project Runway." Why should Kors' investors be expected to forgive the financial equivalent of a fashion train wreck?

The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: