Search News

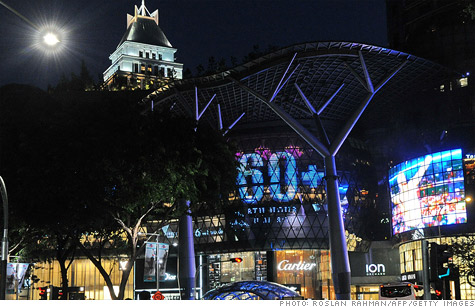

When it comes to wealth, Singapore has the highest number of millionaires per capita.

NEW YORK (CNNMoney) -- The number of millionaires is on the decline in the United States, even as the number of wealthy individuals has increased worldwide.

Millionaire households in the United States decreased by 129,000 in 2011, according to a new study from the Boston Consulting Group. Globally, that figure grew by 175,000. The report defines these households as having over $1 million in cash, stock and other assets, excluding property, businesses and luxury goods.

Singapore has the highest proportion of millionaires in the world; 17% of all households in the Asian city-state have wealth of over $1 million. By comparison, 4.3% of households in the United States had wealth of over $1 million, which ranks it 7th in the world.

The United States also lagged when it came to the proportion of "ultra-high-net-worth" households, defined by the Boston Consulting Group as those with more than $100 million in wealth.

Switzerland topped the list with 11 in every 100,000 households qualifying as "ultra-high-net-worth," followed by Singapore with 10 in every 100,000 households.

The United States didn't make the top 15, the report said.

Across Asia-Pacific nations, excluding Japan, wealth increased by 10.7% to $23.7 trillion, while it declined by 0.9% to $38 trillion in North America.

The consulting group attributes the shift to strong economic growth in Asia, while the United States grappled with a "near default on U.S. government debt, combined with the euro debt crisis" and "a downgrade of the nation's credit rating."

The group expects to see more of the mega-rich crop up across Asia in the near future.

"Wealth in the region is expected to continue to grow at a double-digit rate... reaching $40.1 trillion by the end of 2016, at which time it will have slightly overtaken Western and Eastern Europe combined." ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |