Search News

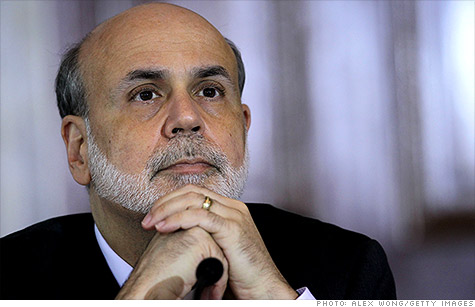

Federal Reserve Chairman Ben Bernanke will weigh the risks and benefits of further stimulus at a meeting next Wednesday. At this point, the benefits seem slim and the risks uncertain.

NEW YORK (CNNMoney) -- Last week, Federal Reserve Chairman Ben Bernanke told lawmakers that the Fed stands ready to give the economy a boost, should the recovery continue to struggle.

But it's unclear just how effective any further economic stimulus would be. Interest rates are already at record lows, yet hiring is tepid and consumer spending is still weak.

Plus, any additional stimulus would come with some risks.

From vocal Fed critics, the most commonly cited danger is that the central bank's policies will eventually lead to higher inflation down the road.

Currently, much of the extra money the Fed has pushed into banks is just sitting there, not making it out to consumers and business. But if the economy starts recovering at a faster pace, that money could pour into the economy very quickly, igniting rapid inflation.

Bernanke has downplayed this threat, pointing out that inflation is currently running under the Fed's target of 2% a year. Wages are not rising rapidly and demand for credit is weak. Home prices remain near nine-year lows.

But should the economy start improving, inflation hawks still fear the Fed will be too late to take away the punchbowl.

Another frequent concern is that the central bank will be too late to tighten the reins once the economy starts to pick up more momentum.

If the Fed finds itself chasing after rapidly rising prices, it will have to start raising the federal funds rate quickly. The central bank's key tool for influencing the economy, the federal funds rate is the interest rate banks charge one another for overnight loans. It influences everything from mortgage rates and auto loans, to the interest rate on savings accounts.

"The danger is that the Fed might have to act very quickly and raise rates dramatically if people start to spend again and banks start to lend again," said Dean Croushore, chair of economics at the University of Richmond and a former Fed economist.

"The more fuel they throw on the fire now, the higher interest rates will have to rise later," he said.

Another way to control inflation that Bernanke has mentioned is to raise the rate on bank reserves. Doing so could entice banks to store more of their excess funds at the Fed instead of lending it out, and slow the pace of money flowing into the economy.

One of the most common next steps discussed by Fed officials, is for the central bank to initiate a third round of large-scale asset purchases, known as quantitative easing or QE3.

The program could come in the form of buying more Treasuries, mortgage-backed securities or some combination of both.

The Fed itself has admitted that buying Treasuries comes with some dangers. The central bank already has a large presence in the bond market, accounting for $1.7 trillion in Treasuries. (In comparison, China owns about $1.2 trillion in Treasuries, and Japan owns about $1.1 trillion.)

As the Fed buys more bonds, economists are unsure of how the central bank will ever be able to wind down those purchases. It's possible the uncertainty could scare off other large bond buyers, like China and Japan, said Jeffrey Bergstrand, finance professor at the University of Notre Dame and a former Federal Reserve economist.

Should interest rates rise rapidly later, those foreign buyers stand much too lose on their investments.

"The Fed has this huge balance sheet and they don't quite know how to unwind all those securities down the road. That creates an uncertainty to foreign central banks and investors that are holding any kind of instrument with a U.S. label on it," said Bergstrand. "You never know when China and Japan are going to say 'we don't want to hold this stuff' and those things can turn on a dime."

Some argue that with rates already hovering near zero, any action by the Fed will have little to no effect on the economy.

"The biggest risk is, it doesn't work, and the market concludes the Fed is losing its impact." said Eric Lascelles, chief economist for RBC Global Asset Management.

In addition to more asset purchases, Bernanke has laid out a few other options for stimulus, but those too could have limited results.

For instance, the Fed could tell the public that it plans to keep interest rates near zero until at least 2015, extending its guidance from its current 2014 forecast.

But it would be hard to make such a pledge convincing, given that the policymaking committee will reshuffle its roster several times before then. The Fed risks losing its own credibility.

Another option entails cutting the interest rate the Fed pays banks on their excess reserves. The Fed currently offers banks a 0.25% rate to keep their extra cash at the central bank. Lowering that rate could get banks to put those funds to another use somewhere else in the economy.

Since banks already have massive reserves and that has yet to jumpstart consumer spending, the policy seems unlikely to make a real difference.

"No matter what the Fed does right now, it will have little impact on both interest rates and the economy," Bergstrand said. "We spend an enormous amount of time discussing these things, but they really don't matter right now."

The Fed's next opportunity to act comes on Wednesday, when its policymaking committee meets behind closed doors. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |