You have a 401(k) balance or other plans you can check on (if you can bear to look today). And you probably know how long you want to keep working and have an idea of what you want to do afterward - travel, launch a second career, kick back. You still have time to refine your goals. But as retirement draws closer, you can't put off creating a concrete savings target and measuring your progress.

One way to look at this is to come up with the Big Number. As a rule of thumb, figure you'll live on 80% of your pre-retirement income when you stop working. So if you make $100,000, that's a retirement income of $80,000. If you assume you have no pension and that you'll collect $20,000 a year from Social Security (get an actual estimate at ssa.gov), the remaining $60,000 will come out of your savings.

The standard financial planning advice is that you can safely withdraw up to 4% of your assets in the first year of retirement. You then increase that amount each year to match inflation. So in this example you'll need to amass $1.5 million by the time you quit ($60,000 divided by 0.04, if you're keeping track at home).

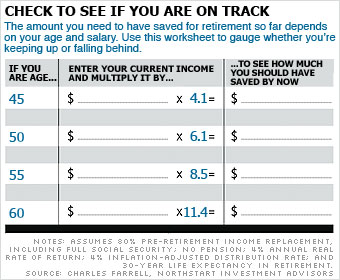

Work up your own Big Number and an annual savings goal with our retirement calculators. You can also use the worksheet to the right to see where you should be by now. Whether you're on target or behind, remember to keep saving. It may seem hard to buy when the market is stumbling, but think of it as a 10%-off sale on stocks you have to buy anyway.

Last updated February 11 2008: 1:33 PM ET