At times like this, you want to make sure you have a mix you can live with. So check on your investments but don't chicken out. As long as you are properly diversified, you can ride out this market downturn too. Retirement may seem close, but your investing time horizon is still decades long.

While boomers should have a sizable stake in bonds and cash to cushion risk, stocks should continue to be the linchpin of your portfolio. Yes, stocks can often deliver sharp losses, but they remain your best bet for outpacing inflation.

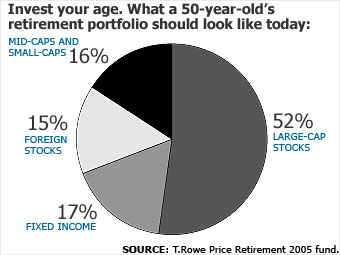

By your late forties, a sound asset mix, according to planners at T. Rowe Price, is 83% stocks and 17% bonds. Gradually shift so that by age 65 you have a 60/40 mix. For maximum diversification, your equity stake should include large-caps, small-caps and foreign stocks. To create your own allocation, use the tools at morningstar.com.

Last updated February 11 2008: 1:33 PM ET