Check your protection against this list:

- Life: Back in the '80s and '90s, you did the right thing by taking out life insurance to protect your family. They'll still depend on you for another 10 years or more, but is your old coverage generous enough to replace the fatter paycheck you're bringing home today? (Conversely, if you've built up enough assets, you might not need it.) To calculate how much insurance is right for you now, fill out the online worksheet from the Life and Health Insurance Foundation for Education. If you need to buy more, term is almost always your best choice. Compared with a whole life policy, you can purchase more coverage for fewer dollars, and rates have been dropping steadily in recent years. Compare premiums at insure.com or accuquote.com.

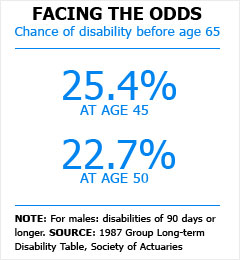

- Disability: You are far more likely to have a temporary disability than to die prematurely. But few people purchase disability coverage on their own, since annual premiums are typically 1% to 3% of your income. Still, if you don't have a group policy at work - or if you think your next job might not provide it - talk to two or three independent insurance agents to compare policies (the Web isn't much help here).

- Homeowners: You've expanded the family room, redesigned the kitchen and turned the basement into a home theater, all while home prices have been skyrocketing around you (at least they were). When is the last time you compared the value of your home with your homeowners coverage? You may need a bigger policy.

- Liability: You could be sued for millions if someone slips on your sidewalk or gets rear-ended by your car. As a highly paid professional, you're a more alluring lawsuit target than you were as a penniless 25-year-old. And you have more to lose. That's why in your peak earning years you need umbrella liability coverage, which provides added protection on top of your auto and homeowners insurance. Most people buy a $1 million policy.

Last updated February 11 2008: 1:33 PM ET