"Now's the time to ask yourself," says financial planner Sheryl Garrett of Shawnee Mission, Kans., "do you want to keep doing what you're doing for the rest of your life?" You still have plenty of time to build a new career or launch a business, but you don't want to jeopardize your family's security by trying out random ventures.

Your first step should be a career assessment, says Mike Haubrich, a financial adviser in Racine, Wis. Ask yourself: Am I happy? Have I advanced as far as I hoped? What are the prospects for my industry? Maybe you'll decide you're satisfied where you are. If so, keep acquiring new skills and network regularly to stay competitive.

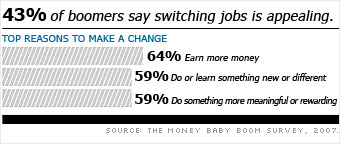

Or you may decide you want to switch jobs. Trouble is, an economic slowdown might be the worst time to look for work. So use this time to lay the financial groundwork:

- Save more. It takes cash to cultivate your career: for training and college courses, for networking events and to pay expenses during a transition. Says Haubrich: "You have to invest in your career just as you do with your portfolio."

- Budget. If you're leaving a corporate job to go solo, price individual health insurance before you leap. Or see if you can switch to your spouse's coverage. Figure out your monthly expenses so you know how much you need to earn. Trim your debt while you still have a steady paycheck.

- Do research. Know the value of the retirement benefits you're giving up, including a 401(k) match and a pension. A traditional pension is worth 20% to 30% in higher pay.

Last updated February 11 2008: 1:33 PM ET