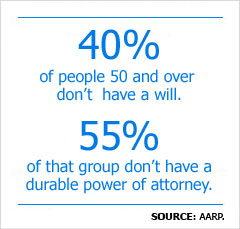

You probably have a will - by age 50, two out of three Americans do. But that's only a start. When did you last update it? And did you complete other essential paperwork? Probably not.

"You want to be sure your kids and spouse will be taken care of," says Robert Armstrong, president of the American Academy of Estate Planning Attorneys in San Diego. "And you don't want all your money going to your ex-spouse or, worse, her no-good second husband, which all too often is what ends up happening."

Here's what you need:

- A will: In it you need to designate a guardian for your children if they're younger than 18, as well as a financial guardian for the money they'll inherit (or a trustee if you set up a trust). "You may want to choose different people for these tasks, since they call for different skills," says Bill Knox, a financial adviser with Regent Atlantic in Chatham, N.J. "A guardian must be willing and able to raise your child, while the trustee should be good with money management."

- Beneficiaries: Name them for your 401(k), IRA and investment accounts. Your will may state that all your money goes to your spouse, but that won't override the beneficiary documents if you've listed someone else.

- Durable power of attorney: With this document, you give a trusted friend or family member the legal right to manage your affairs if you are disabled.

- Health-care proxy: Also known as a living will, this document enables a family member to direct your medical care if you can't do so yourself.

- Living trust: Consider this alternative to a will if you live in a state with slow-moving or costly probate courts. With a living trust, your estate can bypass probate.

- Trusts for your children In most states, your kids will control any money put in their name at age 18 or 21. Putting their assets in a trust allows you to dictate when they collect or make sure they use the funds for college, not a convertible.

Last updated February 11 2008: 1:33 PM ET