Small-caps poised for a comeback

In tough times, big blue chips get all the love. But small-company shares often sprout at the first sign of sunlight.

(Money Magazine) -- Investing in small companies is a risky proposition in any environment. Not only are corporate seedlings untested, but many don't have the resources to compete with bigger, established firms. Throw in an economic monsoon, and you start to worry about their very ability to survive.

Yet a funny thing tends to happen in the depths of great recessions: At the first sign that the worst of the storm may have passed, investors often turn to small businesses with the potential to grow faster than the market as a whole.

It happened in the 1973-74 downturn, when small stocks beat large ones for 10 straight years between 1974 and 1983. It was also true in the Great Depression. In 1932, a year before the recession ended, small stocks led the market - and kept on winning for 11 of the next 13 years. This helps explain why small shares have beaten blue chips by two percentage points a year since 1926.

Is the recent equity rally a sign that a recovery is on the horizon? If it is, here's a clue: Small is leading the way. The Russell 2000 index of small stocks is up 37% since March 9 vs. 26% for the S&P 500 index of large-capitalization shares.

So now is the time to start paying attention to these stocks.

The global economy favors small stocks. While the U.S. economy is expected to emerge from recession this year and grow 1.4% in 2010, economies in Britain, Germany, and Italy might still contract next year.

Why is this important? Unlike large multinational corporations, most small-caps are mainly reliant on domestic demand, says Eric Ende of the FPA Perennial Fund. That could give them a leg up while the rest of the global economy heals.

These firms don't have much debt. Small companies weren't allowed to pig out on credit to the same extent large firms were, says Chuck Royce, president of Royce Funds. So they don't have as many thorny balance-sheet issues to deal with, he says.

Small companies tend to do better toward the end of a recession. While small-caps often lag early on in a downturn, they've historically clobbered blue chips by 11 points in the first year after a recession ends.

Of course, this recession isn't over yet. And this time, small stocks - loosely defined as shares of firms with market values of less than $2 billion - didn't trail large-caps early on. "Everything's been equally crushed," says Greg McCrickard of the T. Rowe Price Small-Cap Stock fund. So who knows if things will play out exactly as in the past?

Whether they're about to pop or not, small-caps should make up 20% to 30% of your U.S. equity stake, says financial planner Dave Fernandez. Don't go much higher - after all, fledgling firms could fold if the economy doesn't improve.

Yet 401(k) investors have only 7% of their stock stake in small-cap funds. So as you rebalance, don't forget to reload on these shares.

For most investors, a diversified small-cap fund is the best option - especially if you don't have time to research stocks. T. Rowe Price New Horizons and Royce Value Plus are among choices in the Money 70, our recommended list of funds.

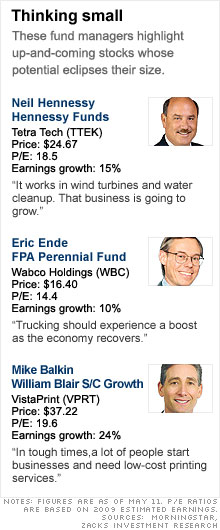

More adventurous investors may prefer individual stocks, in hopes of identifying tomorrow's blue chips today (see the chart above). But if you go that route, be aware that your chances of identifying winning stocks can be surprisingly slim (see "Are Stocks a Loser's Bet?").

And those odds could get even slimmer if this turns out to be a recession that just won't end. ![]()