|

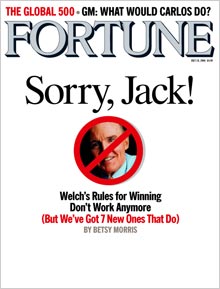

New rule: Find a niche, create something new. Old rule: Be no. 1 or no. 2 in your market.

NEW YORK (Fortune) -- Nobody wants to be a laggard, of course, and there is much to be said for being the market leader. Nike, Wal-Mart and Exxon certainly don't wish they were anything else. But more and more, market domination is no safety net. Disney's (Charts) stranglehold on animated films meant nothing once Pixar's digital innovation hit the scene. AOL's established user base couldn't slow down Google (Charts).

Look at Coca-Cola (Charts), whose still-strong No. 1 position in cola turned out to be not an insurance policy but proof of what consulting firm McKinsey calls the "incumbent's curse." Coke's archrivalry with Pepsi was always about market share - capturing it or defending it by tenths of a percentage point in grocery stores, restaurants, and faraway lands. Coke executives defined their industry as "share of stomach" - that is, the total ounces of liquid an average person consumes in a day and what percentage of it can be filled with Coke. CEO Roberto Goizueta told Jack Welch in a conversation in FORTUNE a decade ago that the soft drink industry wouldn't run out of growth until "that faucet in your kitchen sink is used for what God intended" - dispensing Coke from the tap. But eventually Coke's monomaniacal focus backfired. When bottled waters like Evian and Poland Spring began to gain traction, Coke didn't pay sufficient attention. Its board vetoed management's proposal to buy Gatorade in 2000 (sending the sports drink into the arms of Pepsi (Charts)). Such niche products were viewed as low-volume distractions. Yet last year, in a turnabout that would have been inconceivable a decade ago, soda sales fell, and water, sports drinks, and energy drinks all soared. The jaw dropper: Energy drinks - which boast a profit margin of 85 percent, according to Bernstein Research - are now expected to outearn every other category of soft drink within three years. Not everyone missed the opportunity. Out in Corona, Calif., tiny Hansen Natural Corp. didn't care about being No. 1 or No. 2. CEO Rodney Sacks was instead noticing how consumers were migrating from carbonated soft drinks to juices, iced teas, and "functional drinks." So in the '90s he began moving Hansen beyond its base as a maker of natural sodas (Mandarin Lime, Orange Mango) toward vitamin and energy drinks. Never mind that the energy-drink market was tiny then. "We look for niches and see how they grow," he says. Since launching an energy drink called Monster four years ago (deftly packaged in a dramatic-looking 16-ounce can adorned with a clawmark), Hansen's sales have quadrupled to $348 million, vaulting its shares to $79 from a split-adjusted $2. Coke has gotten religion. CEO Neville Isdell's team is pushing an array of new drinks, including a half dozen of its own energy entries that have earned the company a significant stake in the U.S. market. "We believe there is value in those niches," Isdell told Fortune this spring. "It will not drive the volume number, but volume is something we've often chased to the detriment of the long-term business." Starbucks (Charts), on the other hand, is a drinkseller that has avoided the incumbent's trap. "We've never said we wanted to be No. 1 or No. 2," says CEO Jim Donald. Starbucks isn't a brand per se; it's more an identity that's morphed from a product (a latte) to a place to get wireless, to a place with music to meet friends. "If we said we wanted to be the No. 1 coffee company, that's what would be on our mind," Donald says. Instead, the company has kept moving, evolving, trying new things. "It doesn't matter where you end up," says Donald. "It matters that you're the company of choice." Next: 3: Old rule: Shareholders rule. New rule: The customer is king. ________________________________________________ |

|