Search News

NEW YORK (CNNMoney.com) -- Stocks rallied Thursday after the European Union's promise to help debt-ridden Greece eased worries that a default might hurt global markets.

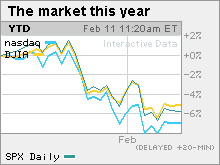

The Dow Jones industrial average (INDU) rose 106 points, or 1%. The S&P 500 index (SPX) gained 10 points, or 1.4% and the Nasdaq composite (COMP) added 29 points, or 1.4%.

Stocks slid in the morning, but managed to turn up after the European leaders promised to help Greece, although details were scarce.

The announcement gave investors the impetus to push the Dow back above the 10,000 mark, which it has been straddling for the last week.

The easing of concerns that Greece and other debt-ridden nations might default enabled investors to take on more risk, including stocks and commodities. The dollar remained stronger versus the euro and weaker versus the yen.

Gains were broad based, with 28 of 30 Dow stocks advancing, led by Boeing (BA, Fortune 500), Caterpillar (CAT, Fortune 500), Chevron (CVX, Fortune 500), Hewlett-Packard (HPQ, Fortune 500), IBM (IBM, Fortune 500) and 3M (MMM, Fortune 500).

Wary after the retreat: Investors have been cautious after a big selloff in January.

Between the rally high on Jan. 19 and the recent low hit last week, the S&P 500 fell 9.2%, getting close to the 10% decline that is the technical definition of a correction.

Stocks fell Wednesday on concerns about the Greek debt situation, the strong dollar and the Federal Reserve's plan to withdraw some of the trillions of dollars it has used to bolster the nation's financial system.

The Dow, S&P 500 and Nasdaq have all declined the past four weeks, as investors have overlooked improved quarterly profits and some positive signs in the economic reports.

Markets remain vulnerable to a pullback following last year's big rally, in which the S&P 500 gained 23%. Between bottoming at a 12-year low in March of 2009 and the end of the year, the S&P 500 gained 65%.

Debt crisis: European leaders have reached a deal to help debt-ridden Greece avoid defaulting on its debt, although details were not expected to be finalized until Monday.

The intervention marks the first time the 16-nation bloc that shares the euro currency has had to bail out a member since the currency zone was created 11 years ago. The deal is expected to involve some form of loans.

Worries that a Greek default would spread to other debt-ridden European nations and destabilize the euro have dragged on global markets for weeks. Portugal, Italy, Ireland and Spain are also heavily debt-laden.

The concern had caused a flight from risk, with investors dumping the euro, U.S. stocks and commodities, and putting money into the dollar and government debt.

Economy: The number of Americans filing new claims for unemployment fell to 440,000 last week from 483,000 in the previous week. Economists surveyed by Briefing.com thought claims would fall to 465,000.

Continuing claims, a measure of those who have been receiving benefits for a week or more, fell to 4,538,000 from 4,617,000 in the previous week. Economists expected 4.6 million claims.

Economists say as many as 150,000 jobs could be lost in February following back-to-back blizzards in the Northeast region, with the storms keeping people home from work and stalling hiring.

A separate report showed foreclosure filings fell almost 10% in January versus the previous month. However the report from Realty Trac also showed that filings rose 15% from a year earlier.

Company news: Boston Scientific (BSX, Fortune 500) reported a smaller quarterly loss versus a year earlier on higher quarterly sales. The medical device maker also announced a restructuring, including a cut of between 8% and 10% of its workforce. Shares fell 10% in unusually active New York Stock Exchange trading.

Power company FirstEnergy (FE, Fortune 500) said it is buying Allegheny Energy (AYE) in an all-stock deal worth $4.7 billion. Shares of Allegheny rallied 11.8% in active New York Stock Exchange trading.

World markets: European markets ended mixed, with London's FTSE 100 up 0.6% and France's CAC 40 down 0.5%. Asian markets ended higher.

The dollar and commodities: The dollar rallied versus the euro and fell against the Japanese yen.

U.S. light crude oil for March delivery rose 76 cents to settle at $75.28 a barrel on the New York Mercantile Exchange.

COMEX gold for April delivery rose $18.40 to settle at $1,094.70.

Bonds: Treasury prices fell, raising the yield on the 10-year note to 3.72% from 3.68% late Wednesday. Treasury prices and yields move in opposite directions.

Market breadth was positive. On the New York Stock Exchange, winners beat losers on volume of 1.08 billion shares. On the Nasdaq, advancers beat decliners nearly three to one on volume of 2.15 billion shares. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |