Search News

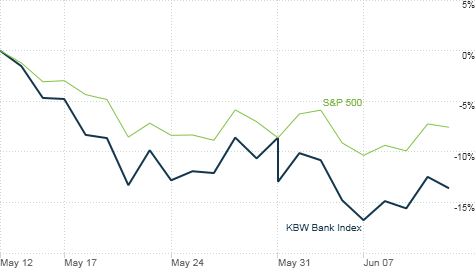

Banks stocks have done even worse than the broader market over the past month -- and some expect that trend to continue.

Banks stocks have done even worse than the broader market over the past month -- and some expect that trend to continue.

NEW YORK (CNNMoney.com) -- Bank stocks have been among the biggest losers during the market's slump of the past month or so. Despite that, many professional investors still don't think banks have hit bottom just yet.

Concerns about the impact of looming Wall Street reform, fraud charges against Goldman Sachs (GS, Fortune 500), and the sovereign debt crisis in Europe are all big headaches that have yet to go away.

That's why some investors think bank stocks are still too expensive.

"If you want to lose your friends their money, buy them bank shares. The valuations just don't fit," said Jonathan Compton, managing director with Bedlam Asset Management, a London-based investment firm.

Compton, who is also the manager of the Touchstone Global Equity fund, said his firm currently owns only one bank stock: Japan's Bank of Yokohama.

Uri Landesman, president of Platinum Partners, a hedge fund in New York, also said that he is wary of bank stocks -- even though the group should outperform the broader market once the recent correction ends.

Banks often lead market rallies and it would appear that many larger financials are poised to capitalize on a pickup in merger activity and other investment banking-related activity.

But Landesman's biggest worry is that banks could continue to lag because of what's happening in Washington -- and he's not willing to stomach the risk.

"If the global recovery is really under way and the market makes a major rally, it is hard to believe financials won't participate," he said. "But digesting what the long-term impact of regulatory changes will be is one of the problems you have with financials. I'm steering clear. There are too many unknowns."

Of course, it's not a given that the global recovery is under way. China's economy still looks healthy but Europe remains a major concern for investors.

"Many larger banks in the U.S. and across the pond have certain exposure to sovereign debt," said Chad Morganlander., a portfolio manager with Stifel Nicolas in Florham Park, N.J. "There will be greater volatility with financials than other sectors in relation to the crisis in Europe."

Morganlander said that banks would be a good place to invest in "at a certain juncture." But he added that it will probably be at least another three months before all the worries about the PIIGS and Wall Street reform have faded.

But even when the new rules for banks in the U.S. are finally laid out, Compton said banks may continue to be left out of any market rally.

Compton argues that one of the biggest drivers for stocks will be an increase in consolidation driven by the large amount of cash that many companies have on their balance sheet.

He said that a boost in takeover activity around the globe should be great news for industrials and technology companies. But banks are one group that will probably sit out any new round of merger mania.

Financial regulators around the world would probably take a critical look at bank deals in light of the concerns about large banks already being considered too big to fail.

"Banks are more dangerous now. Governments are going to clearly say enough is enough," Compton said.

Landesman agreed. He said health care is an area ripe for more mergers and that many consumer related companies will also be eager to pair up.

"The single most important question for the market is whether M&A activity is going to pick up. We should see a lot more deals," he said.

With all that in mind, Landesman's happy to stay away from the banks.

"I'll get plenty juice from industrials, consumer and health care stocks and there's a lot less risk," he said.

Reader comment of the week. I wrote on Thursday about why the Federal Reserve probably has room to keep rates low for the next year at least. Economists I spoke to cited the lack of inflation as a key reason the Fed has such wiggle room. David Arriaga took issue with that and raised a great point that sometimes gets lost when we just focus on wonky statistics.

"Little threat of inflation? Look at the yearly increase of college costs, food to name a few. Little threat? tell that to the little guy. Inflation can only go for so long...the value of money is devalued and countries are picked up for pennies," he wrote.

- The opinions expressed in this commentary are solely those of Paul R. La Monica. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |