Search News

NEW YORK (CNNMoney.com) -- U.S. stocks were set for a weak open Thursday, after a government report showed a rise in the number of unemployment claims filed last week.

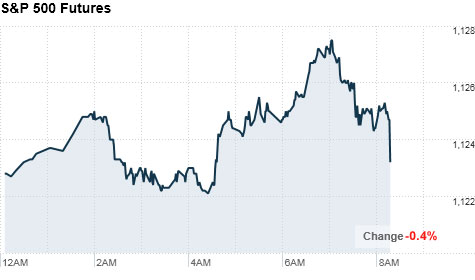

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were narrowly higher. Futures measure current index values against perceived future performance.

U.S. stocks rose Wednesday, but gains were slight, as investors focused on economic data. The Dow added 0.4% and the broader S&P 500 increased 0.6%.

The weekly jobless claims figure unnerved investors a bit as it comes ahead of Friday's monthly jobs report, which economists expect to show the U.S. economy lost 87,000 jobs in July.

"Trading will be pretty light as investors continue to digest corporate earnings and look ahead to the July jobs report due Friday morning," said Derek Hoffman, founder of The Wall Street Cheat Sheet. "The market is going to wait until after tomorrow's report to make the next move."

Jobs: The number of Americans filing for initial unemployment claims climbed 19,000 to 479,000 in latest week. That marks the highest figure in three months and compares with an upwardly revised 460,000 the previous week, the Labor Department said.

Economists surveyed by Briefing.com had expected 455,000 Americans filed first-time jobless claims last week, down from 457,000 the previous week.

The reading comes ahead of Friday's much-anticipated July jobs report from the Labor Department.

Retail sales: Investors will also be watching July chain-store sales for the latest signs on the health of the consumer.

Earnings: Companies due to report financial results include Cardinal Health (CAH, Fortune 500), Cigna (CI, Fortune 500), DirecTV (DTV, Fortune 500) and Time Warner Cable (TWC, Fortune 500).

World markets: European markets edged higher in the early going. Britain's FTSE 100 and Germany's DAX posted mild gains. France's CAC 40 rose 1%.

In Asia, Japan's Nikkei rallied, climbing 1.7%. The Shanghai Composite fell 0.7% and the Hang Seng in Hong Kong finished little changed.

Currencies and commodities: The dollar fell versus the euro, but edged higher against the British pound and the Japanese yen.

U.S. light crude oil for September delivery fell 35 cents to $82.12 a barrel.

COMEX gold's December contract rose $3.30 to $1,199.10 per ounce.

Bonds: Treasury prices were mostly lower Thursday. The 10-year note was down, pushing its yield down to 2.96% from 2.95% late Wednesday. Bond prices and yields move in opposite directions ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |