Search News

Click the chart for more market data.

Click the chart for more market data.

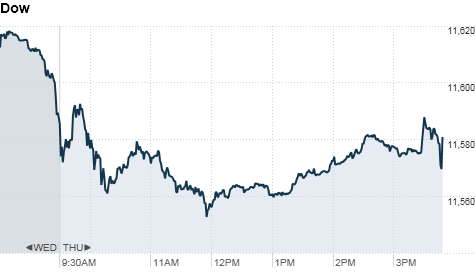

NEW YORK (CNNMoney) -- U.S. stocks ended Thursday's trading session slightly in the red, as trading volume remains light during the last week of the year.

At the closing bell, all three major indexes had lost about 0.1%. The Dow Jones industrial average (INDU) trimmed 16 points, to close at 11,570; the S&P 500 (SPX) fell 2 points to close at 1,258; and the Nasdaq (COMP) shed 4 points, to close at 2,663.

Trading was thin, as the Northeast continues to cope with the lingering effects of a massive snowstorm and many traders left for the holidays. On both the New York Stock Exchange and the tech-heavy Nasdaq, winning stocks beat losers, but by slim margins.

"Most of what we're seeing is really some minor shuffling," said Dan Cook, chief executive officer of IG Markets. "We have some really low volume, so it's really hard to read into general market sentiment."

Better-than-expected reports on jobs, housing and manufacturing data offered traders hope for better economic growth in 2011 -- but the good news wasn't enough to lift stocks during the quiet trading session.

Eager to end the year on a high note, many traders had already closed out their books on Wednesday, after the Dow industrials closed at their highest level since Aug. 28, 2008.

"Why not close out on a really positive note when your books look the best, rather than take a chance today and tomorrow?" Cook said.

Stocks have climbed 6% in December, and are on track to post double-digit percentage gains for the year. For 2010 overall, the Dow is up about 11%, the S&P 500 is up nearly 13%, and the Nasdaq is up almost 18%.

Economy: Thursday's reports mark the last bit of economic data for the year, and all three brought good news.

Before the bell, the Labor Department said initial unemployment claims fell to 388,000 in the week ended Dec. 25. That marked the lowest level since July 2008, and was much better than the 416,000 claims economists had expected.

Meanwhile, the number of Americans filing for their second week of unemployment insurance or more jumped by 57,000 to 4,128,000; in the week ending Dec. 18, based on the latest data available.

The National Association of Realtors reported that pending home sales rose 3.5% in November, far better than the 3% decrease economists were expecting. Pending home sales are a forward-looking indicator for the housing market, reflecting contracts and not closings.

Also, the Chicago PMI rose to 68.6, showing manufacturing activity picked up more than expected in December in the Midwest region. Economists had forecast the index would edge down to 61.5 in November, from 62.5 the previous month. Any number above 50 indicates growth.

Companies: Shares of Anadarko Petroleum Corp. (APC, Fortune 500) spiked 6.2% after the Daily Mail, citing unnamed sources, suggested that mining giant BHP Billiton (BHP) is gearing up to make a cash bid valued at $90 per share for the oil and natural gas producer. Shares of BHP rose 0.2%.

World markets: European stocks closed lower. Britain's FTSE 100 slipped 0.4%, the DAX in Germany fell 1.2% and France's CAC 40 decreased 1.3%.

Asian markets ended mixed. In the final trading day of 2010, Japan's Nikkei dropped 1.1% as the yen advanced to a fresh seven-week high against the dollar.

The yen has climbed more than 12% this year, and its strength has pressured the Nikkei -- which dropped 3% in 2010. Japan has been taking steps to lower the value of the yen, because doing so will improve profits for its powerful export sector.

The Shanghai Composite rose 0.3% and the Hang Seng in Hong Kong added 0.1%.

Currencies and commodities: The dollar lost ground against the euro and the Japanese yen, but gained against the British pound.

Oil for February delivery slipped $1.28 to settle at $89.84 a barrel.

Gold futures for February delivery fell $7.60 to settle at $1,405.90 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.37%, from 3.36% late Wednesday ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |