Search News

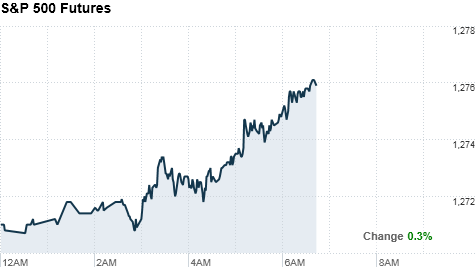

Click chart to view more pre-market action.

Click chart to view more pre-market action.

NEW YORK (CNNMoney) -- U.S. stocks were poised to edge slightly higher Thursday, even though the morning brought a report showing a rise in jobless claims and softer-than-expected same-store retail sales. Investors remain somewhat optimistic ahead of Friday's big jobs report.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were up ahead of the opening bell. Futures measure current index values against perceived future performance.

The Dow posted a fresh two-year high for the third day in a row on Wednesday, following reports that signaled improvement in the employment sector.

Stocks have trended upward, as positive economic reports have buoyed investor confidence about the recovery.

"So far, there's been no data suggesting that what we saw at the end of 2010 -- which was seemingly outright, organic economic growth -- has in any way stalled in 2011," said Mark Luschini, chief investment strategist at Janney Montgomery Scott.

But investors are unlikely to take big positions Thursday, as they gear up for the government's highly-anticipated December jobs report due Friday.

"Everything is leading up to tomorrow," said Luschini. "The ADP data yesterday was strong enough to lead people to believe tomorrow's number won't disappoint, so we'll probably see follow-through in a positive direction -- but don't look for an explosive day one way or the other."

Economy: The Labor Department reported that number of Americans filing for first-time unemployment benefits ticked back above 400,000 last week -- rising by 18,000 to 409,000 in the latest week.

Economists surveyed by Briefing.com had expected jobless claims to increase to 405,000.

On Friday, the government's monthly jobs report is expected to show employers boosted payrolls by 148,000 last month, following a 39,000 increase in November, according to a CNNMoney survey of 27 economists.

That comes on the heels of a report from payroll processor ADP issued Wednesday, showing that private-sector employers added 297,000 jobs in December. Economists had been looking for a rise of 100,000.

Companies: Monthly same-store sales figures are due throughout the morning from major retailers. So far sales data are coming in softer-than-expected, with retailers citing the major snowstorm that hit the East Coast, extra deep discounts and shopper fatigue. Analysts polled by Thomson Reuters expected an overall gain of 3.4% from a year ago.

Before the opening bell, Costco (COST, Fortune 500) logged a 6% jump in December same-store sales, beating the 6.2% increase expected by a Thomson Reuters consensus of analysts. Shares of the retailer edged up slightly in pre-market trading.

Gap shares sank 5%, after the company reported that same-store sales were flat in December. Analysts had forecast a 2.6% rise.

Shares of BP (BP) popped up 2% in early trading, after the National Commission on the BP Deepwater Horizon Oil Spill and Offshore Drilling released a report spreading the blame for the Gulf of Mexico oil spill. The commission blamed "systemic" problems with deepwater drilling, and said only "significant reform" will prevent another.

World markets: European stocks gained in morning trading. Britain's FTSE 100 rose 0.5%, the DAX in Germany jumped 1.2% and France's CAC 40 climbed 0.8%.

Asian markets ended the session mixed. The Shanghai Composite slipped 0.5%, while the Hang Seng in Hong Kong edged up 0.1% and Japan's Nikkei rose 1.4%.

Late Wednesday, Chinese Vice Premier Li Keqiang said China will buy about 6 billion euros ($7.9 billion) in Spanish government debt, according to news reports citing Spanish newspaper El Pais.

Currencies and commodities: The dollar rose against the euro and the British pound, but fell versus the Japanese yen.

Oil for February delivery slipped 18 cents to $90.12 a barrel.

Gold futures for February delivery fell $1.90 to $1,371.80 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.45%, from 3.47% late Friday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |