Click chart for more pre-market action.

Click chart for more pre-market action.

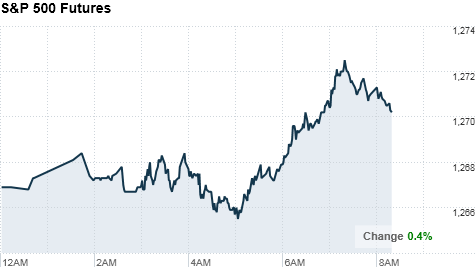

NEW YORK�(CNNMoney) -- U.S. stocks were poised to open higher Tuesday, as Japan's pledge to buy eurozone bonds eased jitters.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were up ahead of the opening bell. Futures measure current index values against perceived future performance.

On Monday, stocks ended just below breakeven, following a sell-off in European markets as investors worried about a possible bailout for Portugal.

Tuesday's light economic schedule could lead markets to snap those losses and drift higher as investors hunt for bargains, said Bruce McCain, chief market strategist at Key Private Bank.

"With a lack of economic statistics out today there's not a whole lot to worry about, so that may give little assurance to those inclined to buy, and give a lift to the market," said McCain.

"But the market is pretty extended in terms of investor sentiment and in terms of having made a strong run, so it needs to pull back at some point and digest the gains it has made," he added.

World markets: European stocks rose in morning trading, amid reports Japan will buy eurozone bonds to help prevent the spread of the region's debt crisis.

"The debt crisis is a lot of what was weighing on the market yesterday, so some of these fears seem overblown as investors look at Japan's entry," said McCain. "Certainly there's a lot of buying power in Japan, so if they are seriously willing to help Europe by buying up some of those bonds, that will limit -- to a degree -- the downside the sovereign debt crisis poses."

Britain's FTSE 100 jumped 1.2%, the DAX in Germany gained 0.8% and France's CAC 40 climbed 1%.

Asian markets ended the session mixed. The Shanghai Composite rose 0.4% and the Hang Seng in Hong Kong gained 1%, while Japan's Nikkei edged down 0.3%.

Economy: The Commerce Department releases its wholesale inventories report before the bell. Inventories are expected to have risen 1.0% in November, after jumping 1.9% in October.

Companies: Verizon (VZ, Fortune 500) is expected to unveil its long-awaited iPhone Tuesday morning. Shares of the company edged up nearly 1% in pre-market trading, while shares of Apple (AAPL, Fortune 500) also rose about 1%.

Shares of Tiffany & Co. (TIF) climbed about 3% before the opening bell, after the jeweler and luxury goods retailer raised its outlook and posted a 11% rise in sales over the two-month holiday period.

Talbots Inc. (TLB) hasn't been faring quite as well in the fourth quarter. Shares of the womens retailer sank 25% early Tuesday after it posted a 6% drop in same-store sales so far this quarter and lowered its full fourth-quarter outlook due to weak customer demand.

Lennar (LEN), one of the nation's largest homebuilders, posted quarterly earnings per share of 17 cents before the opening bell. Analysts had forecast earnings of 3 cents. Shares of the company were up nearly 4% in early trading.

After the closing bell on Monday, Alcoa (AA, Fortune 500) reported earnings per share of 24 cents on income of $258 million -- its highest quarterly earnings in more than two years. Shares of the aluminum producer slipped 1% in pre-market trading.

Currencies and commodities: The dollar lost ground against the euro and the British pound, but gained on the Japanese yen.

Oil for February delivery ticked up 42 cents to $89.67 a barrel.

Gold futures for February delivery climbed $7.70 to $1,381.80 an ounce.

Bonds: The price of the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.31% from 3.30%. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |