Search News

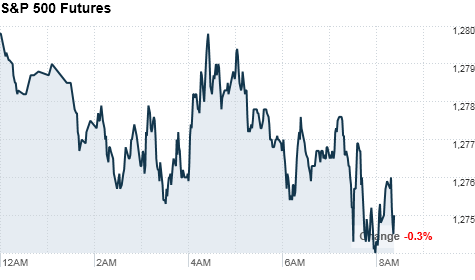

Click chart for more pre- market action.

Click chart for more pre- market action.

NEW YORK (CNNMoney) -- U.S. stocks were poised for a flat open Thursday, despite a better-than-expected report on initial jobless claims, as investors await readings on housing and manufacturing.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were modestly lower ahead of the opening bell. Futures measure current index values against perceived future performance.

On Wednesday, stocks ended lower, as weak results from tech shares took a drubbing and Goldman Sachs' disappointing results pressured financial issues. Shares of Goldman (GS, Fortune 500), Bank of America (BAC, Fortune 500), Morgan Stanley (MS, Fortune 500) and Barclays (BCS) fell more than 3%.

"Even with some disappointing earnings news yesterday and markets knocked back a bit, they didn't fall as much as they could have, which shows there's still much of an appetite out there for building up stocks," said David Jones, chief market strategist at IG Markets. "There's some potential for volatility with a lot of economic data coming out today, but overall, sentiment is still very strong."

While investors may continue to worry about financial stocks given disappointing quarterly earnings from several of the major banks, Jones said he expects earnings to be 'strong overall'.

Morgan Stanley reported a profit surge early Thursday, appeasing some concerns about the health of the financial sector.

Economy: The number of Americans filing for first-time unemployment insurance eased by 37,000 to 404,000 last week. The number was lower than forecast. Analysts surveyed by Briefing.com were expecting 425,000 jobless claims in the latest week.

After the opening bell, the National Association of Realtors will release its monthly report on existing home sales. Analysts polled by Briefing.com expect sales rose to an annual rate of 4.8 million in December, from 4.68 million the previous month.

The index of Leading Economic Indicators from the Conference Board is expected to have risen 0.6% in December after a 1.1% increase the previous month.

After the market opens, the Philadelphia Fed index, a regional reading on manufacturing, is expected to show that activity in that sector slowed in January.

The U.S. government's weekly crude oil inventories report is also due, a day later than usual because of Monday's holiday.

Companies: Morgan Stanley (MS, Fortune 500) posted fourth-quarter earnings of $1.1 billion, or 43 cents a share. Revenue rose 14% from a year earlier to $7.8 billion. Analysts expected the investment bank to report earnings per share of 35 cents on revenue of $7.35 billion. Shares of Morgan Stanley jumped 2% following the report.

After the market closed Wednesday, EBay (EBAY, Fortune 500) said its fourth-quarter revenue rose 5% over the prior year to $2.5 billion. Net income rose to 42 cents a share, or $559.2 million. Shares of the retailer rose 3% in pre-market trading.

Google (GOOG, Fortune 500) is scheduled to report fourth-quarter earnings results after the close of trading Thursday.

World markets: European stocks slumped in morning trading. Britain's FTSE 100 slid 1.4%, the DAX in Germany fell 0.7% and France's CAC 40 edged down 0.2%.

Asian markets ended sharply lower. The Shanghai Composite tumbled 2.9%, the Hang Seng in Hong Kong lost 1.7% and Japan's Nikkei fell 1.1%.

China's gross domestic product, the broadest measure of economic output, expanded at an annual rate of 9.8% in the fourth quarter of 2010. The rate was faster than the 9.6% rate reported in the prior quarter, according to the National Bureau of Statistics.

Meanwhile, inflation cooled -- with the nation's consumer price index rising 4.6% last month, compared to 5.1% in November.

China's rapid growth has sparked fears that its economy may overheat, and many economists are expecting China to further tighten its monetary policy and hike interest rates.

"Chinese growth has accelerated again, which traditionally you would see as a good thing," said Jones. "But the question here is what is China going to do to cap that -- the concern is that we could see another raise of interest rates in China."

Currencies and commodities: The dollar gained against the euro, the Japanese yen and the British pound.

Oil for March delivery slipped 76 cents to $91.05 a barrel.

Gold futures for February delivery fell $12.60 to $1,357.60 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.40% from 3.34% late Wednesday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |