Search News

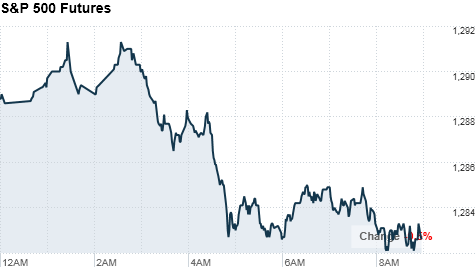

Click chart for more pre-market action.

Click chart for more pre-market action.

NEW YORK (CNNMoney) -- U.S. stocks were set for a slightly lower open Tuesday, as investors weighed a mixed batch of earnings results and a weaker-than-expected report on home prices.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were down ahead of the opening bell. Futures measure current index values against perceived future performance.

Stocks began the week with a solid start, with the Dow inching toward the 12,000 mark on Monday. The blue-chip index has been on an upward trend since Thanksgiving, and is now within a stone's throw of 12,000 -- a level last seen on June 18, 2008.

While economic reports may continue to be lackluster in the coming month, stocks are likely to remain in an upward march as investors focus on strong earnings.

But there will be pauses along the way as investors take stock of their portfolios, said Tom Winmill, portfolio manager at Midas Funds.

"It's going to be choppy, but still a continuing an upward trend," said Winmill. "There's an expectation that earnings will keep improving and we're looking for more surprises on the upside."

Companies: Before the opening bell, DuPont (DD, Fortune 500) logged quarterly results that widely beat expectations. The company also hiked its forecast for the current quarter. The results boosted shares slightly in pre-market trading.

Verizon (VZ, Fortune 500)'s earnings missed by a penny, while revenue fell 2.6% from a year earlier. Shares of the phone service provider edged down less than a percent.

3M (MMM, Fortune 500) posted earnings that were down slightly from a year ago, beating expectations by a penny. Shares of the company fell 2% in early trading.

Johnson & Johnson (JNJ, Fortune 500)'s earnings met expectations, while revenue slipped 5.5%. Shares of the company fell 2% ahead of the market open.

After the bell on Monday, American Express (AXP, Fortune 500) reported earnings of 94 cents per share on revenue of $7.32 billion. The numbers fell a hair short of analyst estimates. Shares fell about 2% in pre-market trading.

Yahoo (YHOO, Fortune 500) is slated to report the market closes Tuesday, and is expected to report earnings per share of 22 cents on $1.19 billion in revenue.

Economy: The Case-Shiller index of home prices in 20 major U.S. markets was released before the opening bell. Signaling that the slump in home prices has deepened, the index fell 1% in November compared with October.

The Conference Board, a business research group, will report its January report on consumer confidence shortly after the opening bell. The index is expected to increase to 53.5 from last month's reading of 52.5.

President Obama is scheduled to deliver his State of the Union address Tuesday night, during which he is expected to talk about the health of the U.S. economy -- especially the labor market.

World markets: European stocks were mixed in morning trading. Britain's FTSE 100 slipped 0.5%, following disappointing fourth-quarter GDP data from the United Kingdom. The DAX in Germany edged up 0.2% and France's CAC 40 was up 0.1%.

Asian markets ended the session mixed. The Shanghai Composite fell 0.7%, and the Hang Seng in Hong Kong ended barely below breakeven. Japan's Nikkei rose 1.2%, after the Bank of Japan kept interest rates steady but boosted its 2010 GDP forecast and said deflation is continuing to ease.

Currencies and commodities: The dollar rose against the euro and the British pound, but fell against the Japanese yen.

Cocoa futures retreated in early trading, after soaring more than 4% in the previous session as the Ivory Coast called for a one-month export ban.

Oil for March delivery slipped $1.13 to $86.74 a barrel.

Gold futures for February delivery tumbled $18 to $1,326.50 an ounce.

"It's been a mixed market for commodities lately, but it's generally been favoring oil and not gold," said Winmill. "There's going to be a rough patch for gold now, because with rising equity prices there will be more optimism for U.S. markets and less worry about finding a safe haven."

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.37% from 3.41% late Monday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |