Search News

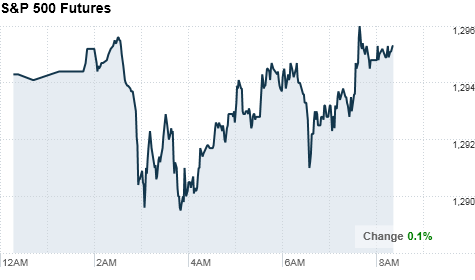

Click chart for more pre-market action.

Click chart for more pre-market action.

NEW YORK (CNNMoney) -- U.S. stocks were poised for a lackluster open Thursday, after S&P downgraded Japan's credit rating and investors mulled disappointing reports on jobless claims and durable goods orders.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were slightly lower ahead of the opening bell. Futures measure current index values against perceived future performance.

Stocks held their gains Wednesday, after the Federal Reserve kept key interest rates steady and left its bond-buying plan in place. The Dow finished at its highest level since the summer of 2008, after rising above the 12,000 mark during the session.

Despite ongoing worries about overseas debt, stocks are likely to continue their upward march, said Chip Brian, chief executive of MySmartrend.com, which analyzes over 6,000 stocks in real time.

"Investor sentiment at large has been so positive post-midterm elections on optimism about controlling government spending and continuation of QE2, that we keep moving up," he said. "We're also in the midst of what has been pretty positive momentum for earnings, with about three-quarters of companies beating estimates so far."

World markets: Early Thursday, Standard & Poor's downgraded Japan's sovereign credit rating to AA- from AA, amid concerns of mounting debt.

"The downgrade reflects our appraisal that Japan's government debt ratios --already among the highest for rated sovereigns -- will continue to rise further than we envisaged before the global economic recession hit the country, and will peak only in the mid-2020s," S&P said in a statement.

Brian said that while this may spook the market in the short term, it's unlikely to drag long-term investor sentiment lower.

"They're downgrading everyone," said Brian. "We've heard about Spain, Greece, Italy, but nothing has blown up yet -- you might see a pull-back in the near-term, but if you look back at the U.S., we still have improved consumer sentiment here."

Asian markets ended the session mixed. The Shanghai Composite gained 1.5% and Japan's Nikkei ticked up 0.7%, while the Hang Seng in Hong Kong slipped 0.3%.

European stocks were higher in morning trading. Britain's FTSE 100 rose 0.2%, the DAX in Germany climbed 0.5% and France's CAC 40 ticked up 0.3%.

Economy: The number of Americans filing for first-time unemployment benefits jumped 51,000 to 454,000 last week, according to the Commerce Department. The reading was much higher than expected. Continuing claims also rose more than expected.

Meanwhile, durable goods orders for the month of December slipped 2.5%, while economists had been expecting the reading to tick up 1.5%.

After the market open, a report on pending home sales is expected to show a 0.5% drop in November, after registering a 3.5% increase the previous month.

Companies: Before the opening bell, Nokia (NOK) reported a quarterly operating profit that fell 23% from a year ago and offered a disappointing outlook for the beginning of the year. Shares of the cellphone maker slumped more than 4% in pre-market trading.

Procter & Gamble (PG, Fortune 500) also logged a lower quarterly profit, though its earnings results slightly beat expectations. Shares of the company were down 2.5% ahead of the market open.

AT&T (T, Fortune 500)'s earnings beat forecasts by a penny, and shares of the company fell 3% following the report. Caterpillar (CAT, Fortune 500) said profit quadrupled in the fourth quarter and logged a 62% surge in revenue that widely beat expectations, sending shares of the company about 3% higher.

Shares of Netflix (NFLX) surged more than 12% as investors focused on the fact that the movie distributor's subsribership topped a record 20 million. After the closing bell Wednesday, Netflix reported better-than-expected earnings but sales came in slightly below forecasts.

Tech giants Microsoft (MSFT, Fortune 500) and Amazon (AMZN, Fortune 500) will release their quarterly earnings after the bell.

Currencies and commodities: The Japanese yen sank versus the dollar, following news of the Japan's downgrade. In other world currencies, the dollar fell against the British pound and the euro.

Oil for March delivery was down 18 cents to $87.15 a barrel.

Gold futures for February delivery rose $1.80 to $1,334.80 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.44% from 3.43% late Wednesday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |