Search News

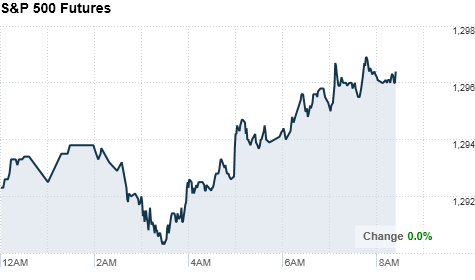

Click chart for more pre-market action.

Click chart for more pre-market action.

NEW YORK (CNNMoney) -- U.S. stocks were headed for modest gains Friday, as investors digested GDP data showing personal consumption spending ticked up to its highest level since 2006.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were slightly higher ahead of the opening bell. Futures measure current index values against perceived future performance.

Stocks managed to log modest gains Thursday, pushing the Dow and S&P to their highest levels since the summer of 2008. The Dow ended 4 points higher at 11,989.83 -- just shy of the 12,000 mark.

U.S. markets have been steadily rising, with the Dow briefly eclipsing the 12,000 benchmark earlier this week.

Stocks are widely expected to continue edging higher for the time being, as more earnings surprise on the upside and the Federal Reserve's bond-buying plan continues to stoke investor optimism.

But any unexpected changes could tip the scales.

"There's some concern that so much of the rise in the last few months has been underpinned by the Fed's policy, so a change in that could provoke a change in sentiment -- but so far there's no sign of that coming, so the next couple months look fairly positive," said David Jones, chief market strategist at IG Markets.

Economy: The U.S. economy grew at a 3.2% annual rate in the fourth quarter, according to an advance reading on gross domestic product released Friday morning. That's up from 2.6% in the third quarter.

Though the figure missed economists' expectations for a slightly higher 3.7% rate, personal consumption spending rose to its highest level since 2006.

After the market opens, the University of Michigan will release its final report on consumer sentiment in January. Economists expect the index to rise to 73.2, up from 72.7 in the previous month.

Companies: Before the opening bell, Ford (F, Fortune 500) posted a fourth-quarter profit of $6.6 billion -- its largest in 11 years. But shares of the automaker fell nearly 7% in pre-market trading.

Honeywell (HON, Fortune 500) posted an increase in earnings that met expectations, and raised its 2011 forecast. It also announced a deal to sell its automotive consumer products business for $950 million. Shares of the company edged 1% lower ahead of the market open.

Chevron (CVX, Fortune 500) posted earnings that easily topped Wall Street estimates, sending shares of the company slightly higher in pre-market trading.

Early Friday, Sara Lee (SLE, Fortune 500) agreed to split into two separate, publicly-traded companies by early 2012. It will pay a $3 per share special dividend before the separation. Shares of Sara Lee edged down about 1% following the news.

Just minutes before the market closed Thursday, Microsoft (MSFT, Fortune 500) reported its second-quarter net income fell to $6.6 billion. But the tech giant's earnings still translated to an all-time high of 77 cents per share. Shares of the company edged up slightly in pre-market trading.

Amazon (AMZN, Fortune 500) also released quarterly results late Thursday, posting sales that topped Wall Street estimates. But investors were rattled by the online retailer's guidance for the current quarter, with operating income expected to slip anywhere from 2% to 34% compared to last year. Shares of Amazon tumbled more than 8% in early trading Friday.

World markets: European stocks were mixed in morning trading. Britain's FTSE 100 dropped 1%, the DAX in Germany edged up 0.2% and France's CAC 40 was up 0.2%.

Asian markets ended the session mostly lower. The Shanghai Composite edged up 0.13, while the Hang Seng in Hong Kong slumped 0.7% and Japan's Nikkei tumbled 1.13%.

Losses in Japan came as investors had a chance to react to Thursday's news, that Standard & Poor's downgraded Japan's sovereign credit rating to AA- from AA on concerns of mounting debt.

Currencies and commodities: The dollar fell against the Japanese yen, but rose versus the euro and the British pound.

Oil for March delivery gained 11 cents to $85.75 a barrel.

Gold futures for February delivery slipped $2.50 to $1,315.90 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.41% from 3.39% late Thursday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |