Search News

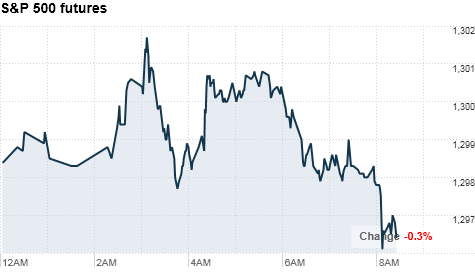

Click chart for more premarket data.

Click chart for more premarket data.

NEW YORK (CNNMoney) -- U.S. stocks were set for a lower open Thursday, as investors mulled over the government's latest jobless claims figures.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were lower ahead of the opening bell. Futures measure current index values against perceived future performance.

Stocks ended little changed Wednesday, as uncertainty about Egypt hung over the market -- two days before the government's all-important jobs report.

"People are positioning for Friday's jobs report which will be exceedingly important -- the ADP number yesterday gave some hope that the number will be good, but we also need to set up for disappointment if it isn't," said Mark Luschini, chief investment strategist at Janney Montgomery Scott.

"The situation in Egypt is also turning a bit more violent and that's disturbing for investors as well, so we'll also be keeping an eye on that to see if it will spread," he added.

All of that uncertainty is likely to muffle any big gains Thursday, said Luschini.

"I wouldn't be surprised to even see the market drift lower today -- nothing dramatic but just as a symptom of having a good couple days earlier in the week and investors just being cautious going into tomorrow's report," he said.

Economy: The U.S. government report on weekly jobless claims was slightly better than expected, with 415,000 Americans filing new claims for unemployment in the week ended Jan. 29.

Economists had expected 425,000 jobless claims, according to a consensus of opinion compiled by Briefing.com. But the four-week moving average edged higher.

Factory orders from the Commerce Department will be released after the start of trading. Orders are forecast to have dropped 0.6% in December, after increasing 0.7% in November.

The ISM services sector index for January is expected to have decreased to 57.0, from 57.1 in December.

Readings on unit labor costs and fourth-quarter business productivity are also due.

Thursday afternoon, Federal Reserve chairman Ben Bernanke will address the National Press Club in Washington.

Companies: Before the opening bell, Tokyo-based Sony Corp. (SNE) logged a 8.6% drop in quarterly profit. But the results were better than what Wall Street had expected and Sony kept its full-year outlook intact, sending Sony's shares about 1% higher.

Merck (MRK, Fortune 500) logged a quarterly loss that slightly beat expectations but issued a cautious outlook for the full year. Shares of the company fell 2% ahead of the opening bell.

Shares of KFC-owner Yum Brands (YUM, Fortune 500) added 3% in premarket trading, a day after the company reported strong earnings.

MasterCard (MA, Fortune 500) and New York Times (NYT) are also on deck to report their quarterly earnings for Thursday morning.

Meanwhile, the nation's major retailers are releasing January same-store sales figures throughout the morning, with more than two-thirds of retailers posting better-than-expected results so far, compared with ThomsonReuters estimates.

Shares of Limited (LTD, Fortune 500) jumped more than 4% in pre-market trading after the clothing company logged a 24% climb in January sales and boosted its fourth-quarter earnings outlook.

Shares of BJ's Wholesale Club (BJ, Fortune 500) surged 12% after the retailer said it is considering selling the company. It also said January sales rose 6.5% from the same month a year ago.

World markets: European stocks were lower in morning trading. Britain's FTSE 100 edged down 0.6% and France's CAC 40 slipped 1%, while Germany's DAX slid 0.3%.

In Asian markets, Japan's Nikkei ended the session 0.3% lower. The Shanghai Composite and the Hang Seng in Hong Kong were closed for Chinese New Year.

Currencies and commodities: The dollar rose against the euro and the Japanese yen, but fell versus the British pound.

Oil for March delivery gained 63 cents to $91.49 a barrel.

Gold futures for April delivery fell $1.20 to $1,330.90 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury edged lower, with a yield rising to 3.5%. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |