Click chart for more premarket data.

Click chart for more premarket data.

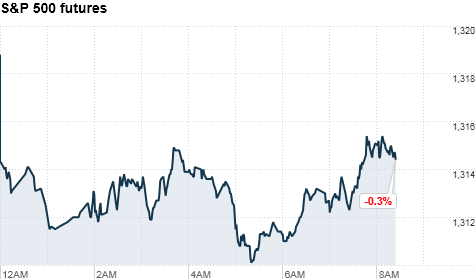

NEW YORK�(CNNMoney) -- Stocks were set for early losses Friday, taking a cue from declines in Europe, amid ongoing uncertainty about Egypt's future.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were lower ahead of the opening bell. Futures measure current index values against perceived future performance.

On Thursday, stocks closed on a mixed note as traders tried to grasp developments in Egypt. The major indexes were little changed on the day, after the Dow had been down more than 75 points in early trading.

After weeks of anti-government protests, Egyptian President Hosni Mubarak said late Thursday that he would delegate powers to the vice president, but remain the titular head of his country.

The move frustrated Egyptians who want Mubarak to stand down immediately, as tens of thousands of protesters streamed into Cairo's Tahrir Square on Friday.

Investors had been sanguine about the situation in Egypt, saying it would not hurt the market unless a broader crisis developed. But with little economic or corporate news to set the tone, traders were refocusing on geopolitical risks.

"The market has been struggling over the last few sessions," said Mark Luschini, chief investment strategist at Janney Montgomery Scott. After a strong start to the year, "there's some buyer's exhaustion" for stocks, he added.

While Egypt is not an oil exporter, it is a key link in the supply chain for oil shipments from the Middle East to Europe and other parts of the world.

"Traders are reassessing their positions in terms of what this could mean in terms of oil prices," Luschini said.

Oil prices held firm early Friday, as the U.S. dollar rose against its main trading partners. European markets were lower in active trading.

Meanwhile, the turmoil in Egypt is raising concerns about the stability of other emerging markets, which have seen a flood of capital from Wall Street since the financial crisis ebbed.

"This is a reminder of the risks that one has to associate with these less-than-developed counties," Luschini said.

Economy: As expected, the White House proposed a plan Friday morning to wind down beleaguered mortgage backing companies Fannie Mae and Freddie Mac, in an effort to reform the housing market.

The U.S. trade gap widened to $40.6 billion in December -- the highest level in three months, according to government data. Analysts surveyed by Briefing.com expected the trade balance to have widened to $40.4 billion, from $38.3 billion in November.

A report on consumer sentiment from the University of Michigan comes out after the market opens.

Companies: Finnish mobile phone maker Nokia (NOK) announced plans to use Microsoft's Windows Phone 7 smartphone platform, in a bid to compete with Apple's (AAPL, Fortune 500) iPhone and Google's (GOOG, Fortune 500) Android.

Nokia also announced a management shakeup, and a realignment of its business units. U.S.-listed shares of Nokia were down 7% ahead of the opening bell, while Microsoft (MSFT, Fortune 500) shares were flat.

World markets: European stocks were lower in morning trading. Britain's FTSE 100 slid 0.6%, the DAX in Germany edged down 0.5%, and France's CAC 40 tumbled 1.1%.

Asian markets ended higher. The Shanghai Composite added 0.3% and the Hang Seng in Hong Kong ticked up 0.5%. Tokyo was closed for a holiday.

Currencies and commodities: The dollar rose against the euro, the Japanese yen and the British pound.

Oil for March delivery gained 41 cents to $87.16 a barrel.

Gold futures for April delivery fell $1.80 to $1,360.70 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.71% from 3.68% late Friday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |