Search News

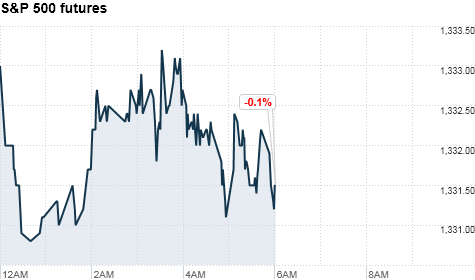

Click the chart for more premarket data.

Click the chart for more premarket data.

NEW YORK (CNNMoney) -- U.S. stocks were headed for a weak opening Thursday, as investors digest the latest reports on inflation, unemployment claims and regional manufacturing activity.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were lower ahead of the opening bell. Futures measure current index values against perceived future performance.

Investors have been in a bullish mood so far this year, as the outlook for the U.S. economy improves and the Federal Reserve remains willing to step in if conditions deteriorate.

On Wednesday, the Fed raised its forecast for 2011 economic growth to between 3.4% to 3.9% in 2011, up from its November estimate of an increase of 3.0% to 3.6%.

Meanwhile, anti-government protests in Bahrain turned violent Thursday, as the unrest that started in Tunisia and Egypt last month has spread across the region. But investors are not too concerned about geopolitical risks for now, Jones said.

"It's in the back of investors minds, but they're not overly concerned at the moment," he said.

U.S. stocks finished at their highest level in more than two years Wednesday, propelled by a $20 billion merger in the pharmaceutical sector and a batch of solid corporate earnings.

Economy: The government's weekly report on the number of people filing for jobless benefits jumped to 410,000 for the week ended Feb. 12, which was close to expectations. The report was expected to show an uptick to 408,000, from 383,000 in the previous week.

The consumer price index for January rose 0.4% month-to-month seasonally adjusted, compared to expectations of a 0.3% increase. The core CPI -- which excludes food and energy prices -- rose 0.2% month-to-month, compared to an expected increase of 0.1%.

Also on tap for the morning is the preliminary Philadelphia Fed index for February, a regional reading on manufacturing. The index is forecast to rise to 21.0, up from 19.3.

Companies: Shares of Dr. Pepper Snapple Group (DPS, Fortune 500) edged up in premarket trading, after the soft drink company reported an 11% increase in diluted quarterly earnings of 49 cents per share. The company said that net sales rose 4% in the quarter, to more than $1.4 billion.

Shares of Williams Partners (WMB, Fortune 500) -- a company focused on natural gas transportation, processing and storage -- jumped 13% in premarket trading, despite reporting quarterly net income of 29 cents per share -- matching the year-ago quarter. The company raised its guidance for 2011-2012 to reflect higher commodity prices and the acquisition of Barnett Shale.

The premarket stock price for Cliffs Natural Resources (CLF) jumped more than 10%, after the company reported that it doubled its full-year revenue to $4.7 billion -- compared to the year before. The company reported quarterly revenue of $1.4 billion and net income of $2.82 per diluted share.

Duke Energy (DUK, Fortune 500) is expect to post earnings per share of 23 cents, on $3.16 billion in revenue.

After the closing bell, Nordstrom (JWN, Fortune 500) is expected to post earnings per share of $1 on revenue of $2.82 billion.

World markets: European stocks were little changed in morning trading. Britain's FTSE 100 was flat, the DAX in Germany edged lower 0.1% and France's CAC 40 ticked up 0.3%.

Asian markets ended the session higher. The Shanghai Composite edged higher 0.1%, the Hang Seng in Hong Kong rose 0.6% and Japan's Nikkei ticked up 0.3%.

Currencies and commodities: The dollar fell against the Japanese yen and British pound, and was flat against the euro.

Oil for March delivery slipped 6 cents to $84.93 a barrel.

Gold futures for April delivery rose $5.80 to $1,375.10 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.57% from 3.62% late Friday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |