Search News

Click on chart for more premarket data

Click on chart for more premarket data

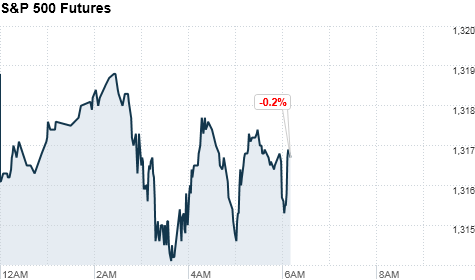

NEW YORK (CNNMoney) -- U.S. stock futures were higher early Monday, after a government report showed a larger-than-expected increase in personal income. But investors keep a wary eye on ongoing tensions in Libya.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures all rose ahead of the opening bell. Futures measure current index values against perceived future performance.

U.S. stocks closed solidly higher Friday, but fears about Libya and the oil market translated into the worst week for stocks since November.

Despite the recent volatility, stocks are off to a strong start his year. The major indexes are all up nearly 5% so far in 2011.

Bruce McCain, chief investment strategist at Key Private Bank, said he thinks the market will continue to move higher, barring any escalation in geopolitical risks.

"The news has been largely positive for equities and there is a bias towards seeing the positive side of things," he said. "As long as the geopolitical situation doesn't get significantly worse, investors will continue to focus on what has been by-and-large good economic news."

Meanwhile, investors were generally unfazed by a potential shutdown of the federal government, which could occur if Congress fails to approve a spending bill before midnight Friday.

Economy: A report from the Commerce Department showed that personal income jumped 1%, while spending by individuals rose 0.2% in January.

Economists were looking for personal incomes to rise 0.3%, and the personal spending figure was expected to go up 0.4%.

Later Monday morning, the Chicago purchasing managers index will be released, followed by pending home sales at 10 a.m. ET from the National Association of Realtors.

The Chicago PMI is expected to decline slightly to 67.5 from last month's 68.8, and pending home sales are expected to fall 3.2%.

Economic data due later this week include the national PMI from Institute for Supply Management on Tuesday, and the government's monthly payroll report on Friday.

Companies: Little corporate news is due out on Monday. Auction house Sotheby's (BID) will report after the market close.

World markets: European stocks were mixed in morning trading. Britain's FTSE 100 slid 0.5%, while the DAX in Germany ticked up 0.2% and France's CAC 40 edged slightly above breakeven.

Asian markets ended the session higher. The Shanghai Composite added 0.9%, the Hang Seng in Hong Kong gained 1.4% and Japan's Nikkei rose 0.9%.

Currencies and commodities: The greenback fell against the euro and the British pound, but rose versus the Japanese yen .

Oil for April delivery slipped 34 cents to $98.22 a barrel.

Gold futures for April delivery rose $4.70 to $1,414.10 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.42% from 3.59% late Friday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |