Search News

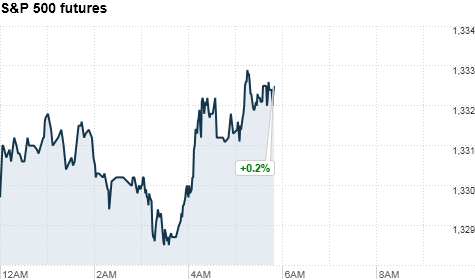

Click the chart for more premarket data.

Click the chart for more premarket data.

NEW YORK (CNNMoney) -- U.S. stock futures were flat Friday, heading for a lackluster open, as investors mulled over the government's monthly payrolls report.

The economy added 192,000 jobs in the month -- roughly in line with expectations, as the unemployment rate ticked down to 8.9%.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were narrowly mixed ahead of the opening bell. Futures measure current index values against perceived future performance.

U.S. stocks posted their best day in three months on Thursday, as Wall Street rallied behind a strong unemployment claims report along with a modest drop in energy prices.

The Dow Jones industrial average (INDU) rose 191 points, or 1.6%, to 12,258. The session's gains were the best for the blue-chip indicator in 2011, and the largest since Dec. 1.

Thursday's rally is a hard act to follow, said Lakshman Achuthan, managing director of the Economic Cycle Research Institute, and the post-rally hangover is partly responsible for lackluster premarket activity.

Also, he said that the strong payroll report has diminished expectations for further government stimulus and that's taking some of the wind out of the sails.

"This is disappointing in that it suggest that there has been no acceleration of private sector job growth from the fourth quarter," said Marc Chandler, global head of currency strategy for Brown Brothers Harriman, in a client note

Asian stocks closing sharply higher and shares in Europe were also higher.

Oil prices rose back near the top of a recent range, hitting a high near $103 a barrel in early trading. And gas prices continued to rise, adding 4.4 cents to a national average of $3.3471

Economy: Twenty-five economists surveyed by CNNMoney were predicting that the economy had added 190,000 jobs in February.

Economists also expected the unemployment rate to rise to 9.2%.

A report on factory orders is due after the opening bell.

Companies: Family Dollar (FDO, Fortune 500) rose about 4% over reports that it rejected a takeover offer from investor Nelson Peltz.

World markets: European stocks were higher in morning trading. Britain's FTSE 100 ticked up 0.5%, the DAX in Germany rose 0.7% and France's CAC 40 advanced 0.2%.

Asian markets ended the session sharply higher. The Shanghai Composite rallied 1.35%, the Hang Seng in Hong Kong jumped 1.2% and Japan's Nikkei gained 1%.

Currencies and commodities: The dollar rose against the euro and the Japanese yen but was flat against the British pound.

Oil for April delivery gained $1.30 to $103.21 a barrel.

Gold futures for April delivery rose $5.60 to $1,422 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.55% from 3.52% late Friday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |