Click the chart for more premarket data

Click the chart for more premarket data

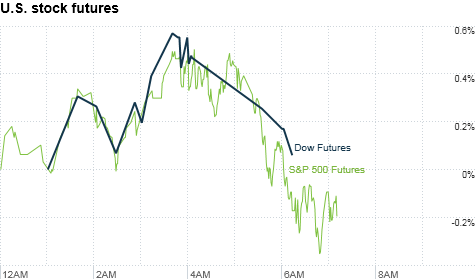

NEW YORK�(CNNMoney) -- U.S. stocks were set for a flat open Wednesday, as investors digested disappointing housing numbers.

Investors also continue to weigh the impact of Japan's deadly earthquake and subsequent nuclear crisis, with other geopolitical tensions around the world.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were little changed ahead of the opening bell. Futures measure current index values against perceived future performance.

In a televised speech Wednesday, Japan's emperor told citizens not to give up hope as the country grapples with an epic earthquake.

"It's quite rare of the emperor to appear on television, and that has made investors a little nervous," said David Jones, chief market strategist with IG Markets in London.

Prior to the speech, Tokyo's Nikkei index rose 5.7% Wednesday, a bounceback from two days of losses that had drained more than 16% from the index. (CNN.com's Japan coverage)

The increasingly desperate situation at Japan's nuclear plants has resulted from the 9.0-earthquake that rocked Japan on March 11, and caused a massive tsunami that has ravaged the world's third-largest economy. The death toll now stands at 3,771 people.

Geopolitical concerns in other parts of the world are also likely to keep investors on edge throughout the day.

Early Wednesday, Moody's Investors Service downgraded Portugal's credit rating from A1 to A3 -- a lower investment grade status. And Fitch downgraded Bahrain's debt to below investment grade, following a government clash with protestors.

Hundreds of riot police used tear gas and armored vehicles to drive out antigovernment protesters in Bahrain's capital, Manama, early Wednesday.

Asian markets ended higher, with the Shanghai Composite index rising 1.2% and Hong Kong's Hang Seng index edging up 0.1%. Meanwhile, European markets were mixed Wednesday morning. The FTSE 100 and France's CAC 40 both dropped about 0.4%, while the DAX in Germany rose 0.5%. (World markets)

U.S. stocks are coming off sharp losses Tuesday, as investors looked past a somewhat positive statement from the Federal Reserve, to focus on the deteriorating situation at Japan's Fukushima Daiichi nuclear power plant.

Investors, stunned by the devastation in Japan, had been reducing their exposure to risky assets and flocking to investments that are considered safe, including U.S. Treasuries. But the Wednesday rebound in Japanese stocks sent U.S. bond markets lower.

Economy: Wednesday morning, the government released a report on new home construction and applications for building permits in February.

The Commerce Department reported that an annual rate of 479,000 new homes were built in February, down from a revised 618,000 in January.

Economists had expected the number of housing starts to rise to an annual rate of 575,000 units in the month, according to consensus estimates from economists surveyed by Briefing.com.

Building permits -- considered a leading indicator of activity in the housing sector -- fell to an annual rate of 517,000 last month, down from a revised 563,000 in January.

Permits were expected to have increased slightly to 563,000, according to Briefing.com.

Separately, the government's Producer Price Index showed that prices at the wholesale level jumped 1.6% in February, which was much more than expected. The PPI was forecast to show prices at the wholesale level increased 0.6% in February.

Core PPI, which excludes food and energy costs, increased by 0.2% in the month, matching expectations.

A report on the U.S. current account balance in the fourth quarter and the government's weekly energy inventory report are also on tap.

Currencies and commodities: The dollar gained against the euro and the British pound, but eased against the Japanese yen.

Oil prices -- which fell nearly 4% on Tuesday -- were higher early Wednesday, as concerns the ongoing turmoil in North Africa and the Middle East were revived. Oil for April delivery gained $1.80 to $98.98 a barrel.

Gold futures for April delivery climbed $11.10 to $1,403.90 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury was slightly higher, sending the yield ticking up to 3.3%. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |