Search News

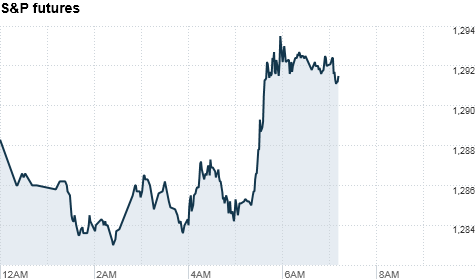

Click the chart for more premarket data.

Click the chart for more premarket data.

NEW YORK (CNNMoney) -- U.S. stocks were poised for a flat start Wednesday, as investors remained nervous about the spreading unrest in the Middle East region and Japan's recovery efforts.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were down 0.2% ahead of the opening bell. Futures measure current index values against perceived future performance.

"While there's a lot of big news going on, it's really a lot of the same geopolitical stories we've seen over the past few weeks," said David Jones, chief market strategist at IG Markets.

Jones said investors were shrugging off the Egyptian market plunge. The stock market in Egypt had been closed since Jan. 27, and most traders had already anticipated the sharp drop.

Other world markets were stronger. Asian markets ended the session mixed. The Shanghai Composite added 1%, while the Hang Seng in Hong Kong edged down 0.1%.

Japan's Nikkei closed 1.7% lower, but it was the smallest percentage change in the index since the massive earthquake and devastating tsunami.

On Wednesday, the Japanese government said the quake would cost the nation $300 billion -- more than double the cost of the Kobe quake in 1995, according to published reports.

European stocks were mixed in afternoon trading. Britain's FTSE 100 was flat, the DAX in Germany fell 0.3% and France's CAC 40 rose 0.1%.

After three days of rallying to reclaim pre-Japan earthquake levels, U.S. stocks slipped back into the red on Tuesday -- with the Dow finishing 18 points, or 0.2%, lower.

Economy: Investors will get February new home sales figures from the Census Bureau at 10 a.m. ET. Economists are looking for 288,000 annualized units for February, up slightly from 284,000 units in January.

The government's weekly report on crude inventories will also be released after the opening bell.

Companies: Before the bell, General Mills (GIS, Fortune 500) said its fiscal-third quarter earnings rose 18%. The cereal maker, which raised prices in October, said it expects strong earnings growth in the fourth quarter.

Shares of homebuilder PulteGroup (PHM) rose 5% in premarket trading after Goldman Sachs raised its price target on the stock.

Bank of America (BAC, Fortune 500) shares slid 1.7% premarket. The bank said in that it would need to revise its dividend plan after the Fed objected to the company's original proposal.

Currencies and commodities: The dollar rose against the euro, the Japanese yen and the British pound.

Oil for May delivery, which became the front-month contract Wednesday, gained 42 cents to $105.39 a barrel.

Gold futures for April delivery rose $5.50 to $1,433.10 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.30% from 3.33% late Tuesday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |