Search News

Click the chart for more market data.

Click the chart for more market data.

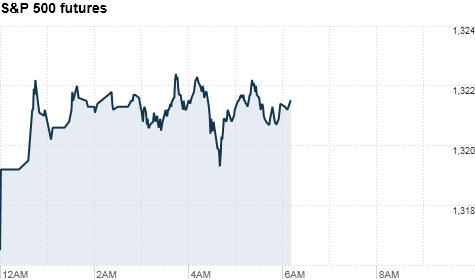

NEW YORK (CNNMoney) -- U.S. stocks were set to open higher Wednesday, as investors considered two job reports: one that showed fewer planned job cuts and one that showed an increase in private sector employment.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were higher ahead of the opening bell. Futures measure current index values against perceived future performance.

So far this week, investors have shrugged off ongoing global concerns in the Middle East, Libya and Japan. Stocks in Japan rallied overnight, while shares in Europe were higher in active trading.

On the domestic front, it was all about jobs. Before the opening bell, one report showed that employers announced fewer planned job cuts in March, even as government sector layoffs mounted.

"The employment side of things looks pretty good," said Anthony Conroy, head trader at BNY ConvergEx Group.

A second report showed private sector employment rose by 201,000 in March, according to payroll processor ADP. The figure came in slightly below forecasts but remained above 200,000. Investors look to the ADP report as a guide for what's coming in Friday's government report.

A CNNMoney survey of 18 economists forecasts an 180,000 jump in payrolls. The unemployment rate is expected to hold at 8.9%.

Economy: There's been renewed concern about what the Fed's next interest rate move will be and that may keep investors on edge.

On Tuesday, comments by Dallas Fed president Richard Fisher, a consistently hawkish voting member of the central bank's policy setting committee, raised speculation that Fed could move to tighten its easy money policies sooner than expected.

In addition, Conroy said gains in Asian and European markets were helping boost market sentiment, although there are still worries about the debt problems facing troubled economies such as Portugal and Spain.

U.S. stocks finished near session highs Tuesday, thanks to solid gains in telecommunication and retail stocks including AT&T (T, Fortune 500) and Verizon (VZ, Fortune 500).

Companies: Shares of Family Dollar (FDO, Fortune 500) rose nearly 3% after the discount retailer reported slightly better-than-expected sales and earnings, and said it's on track to continue growing, albeit at a measured pace.

Shares of Cephalon (CEPH) surged 31% in premarket trading after specialty pharmaceutical firm Valeant (VRX) launched a hostile bid for the U.S. drugmaker.

Private equity firm Apollo Global (APO) will likely get an early boost. The firm priced its initial public offering at $19 a share -- the top end of its expected range. The offering drew strong demand.

BlackRock's (BLK, Fortune 500) stock rose more than 5%. The investment firm is replacing Genzyme (GENZ, Fortune 500) on the S&P 500.

World markets: European stocks were higher in midday trading. Britain's FTSE 100 rose 0.4%, the DAX in Germany jumped 1.4% and France's CAC 40 added 0.8%.

Asian markets ended mostly higher. Japan's Nikkei rallied 2.6% and the Hang Seng in Hong Kong added 1.7%, while the Shanghai Composite was little changed.

Currencies and commodities: The dollar rose against the euro and the Japanese yen, but fell versus the British pound.

Oil for May delivery slid 44 cents to $104.35 a barrel.

Gold futures for April delivery rose/fell $2.10 to $1,418.30 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury was steady, with the yield unchanged from Tuesday at 3.49%. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |